Leave of Absence Unemployment: How to Manage Your Finances

Leave of absence unemployment pertains to the condition of an individual who takes an extended leave from work and loses their employment opportunities as a result. This can significantly impact their personal finances, leading to financial challenges that can be difficult to overcome.

Are you struggling with taking a leave of absence from work due to unemployment? Check out this informative Youtube video that provides expert advice and solutions to your employment problems!

Understanding Leave of Absence Unemployment

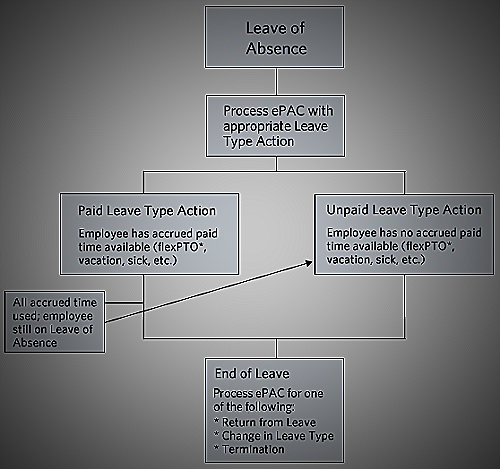

A leave of absence unemployment occurs when an employee takes a temporary break from work due to valid reasons such as health problems, caregiving responsibilities, or personal reasons. During this time, the employee is not paid, but may be able to continue insurance benefits under certain circumstances.

However, taking a leave of absence may affect an employee’s eligibility for unemployment benefits. In most states, unpaid leaves of absence are specifically exempted from being eligible for unemployment insurance benefits.

This means that if an employee takes an unpaid leave of absence, they may not be able to receive unemployment benefits if they become unemployed after the leave.

Exceptions to this rule are made under certain circumstances, such as if the leave was due to medical reasons or if the employee was guaranteed to return to work after the leave. It is important for employees to understand the impact of taking a leave of absence on their eligibility for unemployment benefits and to make informed decisions based on their individual circumstances.

Assessing Your Financial Situation

Leave of absence unemployment can cause a significant strain on one’s financial situation. It is crucial to conduct a comprehensive evaluation of your financial situation to identify potential sources of income and reduce expenses.

Start by creating a budget and identifying your monthly expenses. Then, evaluate your potential sources of income, such as unemployment benefits, severance pay, and any other sources of financial assistance available to you.

Consider ways to reduce expenses, such as cutting back on non-essential purchases and services, negotiating bills, and downsizing your living arrangements, if possible.

Assessing your financial situation can help you create a plan to manage your finances during leave of absence unemployment and avoid any financial hardships.

Managing Debt during Leave of Absence Unemployment

When an individual experiences leave of absence unemployment, it can often lead to difficulty in managing debt. It is essential to identify debt management strategies during this period to avoid falling into a debt trap.

One of the crucial things to consider is the impact of unemployment on credit scores. During the period of leave of absence, it is common for credit scores to drop due to lack of income, making it difficult to qualify for loans or credit cards.

To prevent this from happening, it is important to maintain a good credit score by paying bills on time, reducing credit card balances, and avoiding opening new credit accounts.

Another debt management strategy to consider during leave of absence unemployment is budgeting. It is essential to prioritize essential expenses such as housing, food, and utilities and cut back on discretionary spending such as entertainment costs.

One can also seek financial counseling services to assist in budgeting and managing debts effectively.

Moreover, unemployed individuals can opt for debt consolidation options such as credit counseling, debt management programs, or debt consolidation loans. These options can help to lower interest rates and payments, which can make the debt more manageable.

Despite these options, individuals can also apply for unemployment benefits, which can help to cover basic expenses during the leave of absence period. However, eligibility for these benefits varies depending on the state laws and the circumstances surrounding the leave and employment relationship.

To conclude, managing debt during leave of absence unemployment can be challenging, but it is essential to prioritize budgeting, maintain a good credit score, and consider debt consolidation options with expert counsel to minimize the risks of falling into a debt trap.

Exploring Other Financial Assistance Programmes

Aside from unemployment insurance benefits, there are alternative sources of financial assistance available for those experiencing leave of absence unemployment. These include food assistance, housing assistance, and utility assistance programs.

If you are experiencing financial hardship due to a leave of absence, it is important to explore these resources and apply for them as soon as possible.

One option to consider is local and university scholarships, which can provide financial aid for students and their families. Campus employment is also a viable option for students to earn extra money while in school.

Peer-to-peer lending and crowdfunding may also be considered, but it is important to fully understand the risks and benefits of these alternatives before pursuing them.

Looking into Legal Options

When an individual experiences leave of absence unemployment due to employer discrimination or retaliation, it can be a difficult situation to navigate. Fortunately, there are legal options available for those who qualify.

In such cases, seeking legal counsel from workers’ compensation lawyers can be beneficial. These specialized lawyers can help eligible individuals access financial support after being injured or becoming ill due to work-related reasons.

It’s important to note that employers have separate responsibilities to employees under the workers’ compensation system and disability discrimination laws, such as the Americans with Disabilities Act (ADA) and the Fair Employment and Housing Act (FEHA).

While leaves of absence are generally unpaid, insurance benefits may be continued in some circumstances. However, most states specifically exempt unpaid leaves of absence from eligibility for unemployment insurance benefits, except for certain exceptions based on the nature of the leave and employment relationship.

In the event of leave of absence unemployment due to discrimination or retaliation by an employer, consulting with a workers’ compensation lawyer can help individuals explore their legal options and determine the best course of action to take.

Conclusion

When faced with leave of absence unemployment, it is important to understand the potential consequences and seek the right support. Studies have shown that sick leave can be a predictor of future unemployment and disability pension.

While leaves of absence are generally unpaid, there are exceptions that may allow for eligibility for unemployment insurance benefits, depending on the circumstances. It is also important to consider financial aid alternatives, such as local and university scholarships, campus employment, peer-to-peer lending, and crowdfunding.

Additionally, employers have separate responsibilities to employees under workers’ compensation and disability discrimination laws, and good mental health is key for employability and job retention. By being proactive and seeking the right support, individuals can better navigate the challenges of leave of absence unemployment.