Whats a W9: Everything You Need to Know

What is a W9?

A W9 is a tax form used to collect personal identifiable information from an individual or business that is required to report income paid to an individual, such as a self-employed contractor or freelancer. The form is officially called Form W-9, Request for Taxpayer Identification Number and Certification.

Who Needs to Fill Out a W9?

Individuals or businesses that are required to report income paid to another individual, such as a self-employed contractor or freelancer, are typically required to have them fill out a W9 form. Employers or businesses that pay non-employee compensation, such as rent or royalties, also use the W9 form to collect the necessary tax information.

What Information is Required on a W9?

The W9 form requests personal identifiable information such as the individual or business’s name, address, and taxpayer identification number (TIN). The TIN can be a Social Security number or an employer identification number (EIN) for businesses.

The individual or business must also certify that the information provided is accurate and that they are not subject to backup withholding.

Check out this Youtube video: “What is Form W-9 & How You File It? | TaxBandits – YouTube” to learn more about the requirements and processes of tax filing.

What is a W-9 Form?

A W-9 form is an Internal Revenue Service (IRS) tax form that businesses in the United States use to request taxpayer identification number (TIN) and certification from freelance workers, independent contractors, vendors, and other service providers.

This form is required by businesses that need to file an information return with the IRS, such as Form 1099-MISC, which serves as a record of the payments made to the aforementioned workers.

Form W-9 contains basic personal information about the taxpayer, such as their name, address, and TIN.

Who Needs to Complete Form W-9?

A W-9 form only needs to be completed by the workers who receive payments from businesses, such as freelancers, independent contractors, and vendors.

Businesses that make payments to these workers and need to report those payments to the IRS are required to request that the worker complete a W-9 form.

What Information is Required on a W-9?

The following information is required to fill out a W-9 form:

- Full name or business name

- Address

- Taxpayer identification number (TIN)

- Classification as either an individual or entity

If the taxpayer is an entity, the business must provide additional information such as the owner’s name and address.

Does a W-9 Need to Be Updated Annually?

No, a W-9 form typically does not need to be updated annually. However, if there are changes to the information submitted, the taxpayer is responsible for notifying the business and updating the form accordingly.

For example, if the taxpayer changes their name or address or if the TIN changes, they should fill out a new W-9 form and submit it to the business.

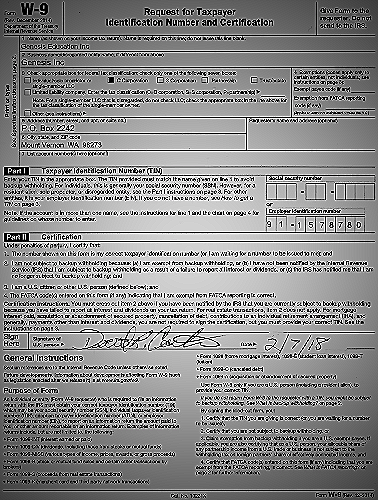

How to Fill Out a W-9

If you’re an independent contractor or receive income from sources other than standard employee wages, you may need to fill out a W-9 form. Here’s a detailed guide on how to properly fill out a W9 form.

On the top of W-9 tax form:

Start by providing your name and the business name (if applicable) that the income is being reported under, this should match the name used on your federal tax return. Next, provide your business entity, mailing address, and signature.

Part I:

In Part I, you need to provide your Taxpayer Identification Number (TIN). The TIN is usually your Social Security Number (SSN) or Employer Identification Number (EIN).

For an individual, the TIN is their SSN. For a business, the TIN is the EIN.

This information is used to report income to the Internal Revenue Service (IRS).

Part II:

Part II requires you to certify that the information you provide on Form W-9 is correct and accurate. By signing and dating Form W-9, you are certifying that the TIN you are providing is correct, that you are not subject to backup withholding, and that you are a U. S. citizen (or resident alien) or a foreign entity that is subject to U. S. withholding and reporting.

IRS W-9 Form Terms

Form W-9 is a document used in the United States tax system for a third party to file an information return with the Internal Revenue Service (IRS). Here are some important terms to know:

- Taxpayer Identification Number (TIN): A nine-digit number used to identify individuals or businesses for tax purposes. This can be a Social Security Number (SSN) or an Employer Identification Number (EIN).

- Certification: The act of stating that the information provided is true and accurate to the best of your knowledge. By signing Form W-9, you are certifying that the TIN provided is correct and that you are not subject to backup withholding.

- Backup Withholding: A tax withheld from certain payments made to taxpayers who have not provided their TIN or provided an incorrect TIN, among other reasons.

- Information Return: A tax document used to report various types of income to the IRS, including wages, dividends, and non-employee compensation.

It’s important to understand these terms before filling out Form W-9 to ensure you provide accurate and valid information.

W-9 2020 – Is the Form Different Than Previous Years?

While some tax forms may experience changes from year to year, the W-9 form for the year 2020 has remained the same as the previous years. The form, also known as the “Request for Taxpayer Identification Number and Certification,” is still used to obtain correct taxpayer identification numbers and certification for tax purposes.

The form requires you to provide your name, TIN, and other essential information related to your tax status. It is essential to provide correct and updated information to avoid penalties and discrepancies in your tax records.

W-9 for Businesses

Form W-9 is a document that businesses use to gather information from individuals or entities before paying them income. This form is also used to verify the individual’s tax identification number (TIN) before submitting an information return to the IRS.

The W-9 form requests information such as the individual or entity’s full legal name, address, and taxpayer identification number. The form also contains a certification that the information provided is accurate and complete and that the individual or entity is not subject to backup withholding.

Employers or other entities that need to report payments made to individuals such as self-employed contractors, freelancers, or other service providers typically require a W-9 form to be completed by the payee before they can process payments.

It is important to note that although the form requests personal identifiable information, it should be kept confidential by the business and should not be shared with third parties unless required by law.

If you are a business owner or work with businesses that need to report payments made to individuals, it is important to understand the role of the W-9 form and use it appropriately.

W-9 Tax Form Questions

If you’ve ever been asked to complete a W-9 form, you may have some questions about what it is and why it’s needed. Here are some frequently asked questions about the W-9 form:

What is a W-9 form, and why do I need to complete it?

The W-9 form, officially called Form W-9, Request for Taxpayer Identification Number and Certification, is used by a third party who must file an information return with the Internal Revenue Service (IRS). It requests your taxpayer identification number (TIN) and certifies that you are not subject to backup withholding.

What kind of information is requested on a W-9 form?

You will be asked to provide your name, address, and TIN on the form. This information is used to verify your identity and to report income paid to you to the IRS.

Do I need to complete a W-9 form if I’m self-employed?

Yes, if you are self-employed and receive income from a client, you may be asked to complete a W-9 form. This is because the client is required to report the income they paid to you to the IRS.

Do I need to complete a new W-9 form every year?

No, you do not need to complete a new W-9 form every year unless your information has changed (such as a name change or a new address). The W-9 form is valid until you provide a new one with updated information.

What should I do if I don’t have a TIN?

If you are asked to complete a W-9 form but do not have a TIN, you should apply for one and write “applied for” in the space for the TIN. You can still sign and date the form and provide it to the requesting party.

Related Topics

If you need more information about Form W-9, here are some related topics for research purposes:

How to Fill Out Form W-9

To fill out Form W-9, you need to provide your full name, tax identification number, address, and other personal information. Make sure that all the information you provide is accurate, as it will be used for reporting income paid to you.

Learn more about how to fill out Form W-9 in this guide.

What is the Purpose of Form W-9?

Form W-9 is used to provide personal identifiable information to a person or business for reporting income paid to individuals, such as self-employed individuals. This form is also required for real estate transactions and mortgage interest payments.

Learn more about the purpose of Form W-9 and when it is needed.

How to Apply for a Taxpayer Identification Number

If you do not have a taxpayer identification number (TIN), you will need to apply for one before you can fill out Form W-9. Learn more about how to apply for a TIN and what documents you need to provide.

What to Do if You Don’t Have a TIN

If you are asked to fill out Form W-9 but do not have a TIN yet, you can write “Applied for” in the space for the TIN. Learn more about what you need to do if you do not have a TIN yet.

W-9 Form Changes 2020

Although some tax forms change from year to year, Form W-9 has not changed for the year 2020. Learn more about the W-9 form and any changes for previous years.

W-9 Form Definition

The W-9 form is used to collect Taxpayer Identification Number (TIN), Employer Identification Number (EIN), or Social Security information from individuals and businesses. Learn more about the definition and purpose of the W-9 form.

Conclusion

In summary, Form W-9 or Request for Taxpayer Identification Number and Certification is a crucial tax form for individuals and businesses in the United States income tax system. It is used to report income paid to self-employed individuals, confirm tax identification numbers, and validate personal identifiable information.

It is essential to provide accurate information on the form to avoid errors and penalties. It is also recommended to seek assistance from a tax professional to better understand the W-9 form and its importance in the tax filing process.

References

- About Form W-9 | Internal Revenue Service

- Form W-9, Request for Taxpayer Identification Number (TIN) and Certification | Internal Revenue Service