Types Of Claims In Insurance: A Comprehensive Guide

Understanding the different types of claims in insurance is crucial for individuals and businesses alike. Whether it’s health insurance claims, first-party insurance claims, or third-party insurance claims, having knowledge of these different types can help ensure that claims are processed accurately and efficiently.

By being informed about the various types of insurance claims, individuals can also make more informed decisions when it comes to choosing the right insurance coverage for their specific needs. This knowledge can ultimately save valuable time and money by avoiding potential pitfalls in the claims process.

Check out this Youtube video: Learn about the top 5 types of claims in insurance and how to handle them effectively as a public…

Understanding Types of Claims in Insurance

Definition of insurance claims

An insurance claim is a formal request made by a policyholder to their insurance company for coverage or compensation for a covered loss or policy event. It involves the insurance company validating the claim and, upon approval, issuing payment to the insured or an approved interested party on behalf of the insured.

Common types of insurance claims

| Type of Claim | Description |

|---|---|

| Health Insurance | Claims for medical expenses incurred by the insured individual or their dependents. |

| First-Party Insurance | Claims filed by the policyholder for benefits under their insurance policy after an accident or loss. |

| Third-Party Insurance | Claims made against the policyholder by a third party seeking compensation for damages due to the policyholder. |

| Homeowner Claims | Claims for property damage or loss related to the insured individual’s residence. |

Importance of categorizing claims

Categorizing claims is crucial for accurate reporting of financial performance. Each type of claim differs in cost, and proper categorization allows insurance companies to analyze and manage claim patterns effectively.

It enables them to understand the specific areas where they incur the highest costs, thus aiding in strategic decision-making.

Types of Property Insurance Claims

Explanation of property insurance claims

Property insurance claims refer to the compensation sought by policyholders for damage to their physical assets, such as homes, buildings, or other properties covered by the insurance policy. These claims can arise from various causes, including natural disasters, accidents, theft, and vandalism.

Policyholders file these claims to recover the financial losses incurred due to the damage or loss of their properties.

Examples of property insurance claims

- Fire and Lightning Damage: Instances where properties are damaged due to fires or lightning strikes.

- Water Damage and Freezing: Claims resulting from water-related incidents, such as pipe bursts, flooding, or freezing damage.

- Wind and Hail Damage: Claims arising from the destruction caused by strong winds and hailstorms.

- Theft and Vandalism: Claims filed for property loss or damage due to theft or intentional destruction by vandals.

Process of filing property insurance claims

Filing a property insurance claim involves several steps, including documenting the damage, notifying the insurance company, preventing further damage, and requesting a certified copy of the policy. It is crucial for policyholders to thoroughly document the loss with photographs or videos, promptly notify their insurer, and take necessary measures to prevent additional damage to the property.

Additionally, keeping copies of receipts and detailed photos of the damage is essential for a successful claim submission.

Types of Liability Insurance Claims

Explanation of liability insurance claims

Liability insurance claims refer to the requests made by policyholders to receive compensation for financial losses or damages incurred due to someone else’s actions or negligence. These claims typically involve situations where the insured party is held legally responsible for harm caused to another person or property.

Examples of liability insurance claims

- Property Damage Lawsuit: A claim filed when the insured is held responsible for damaging someone else’s property.

- Slip and Fall Incident: A claim filed by an individual who sustains injuries due to slipping or tripping on the insured party’s premises.

- Product Liability Lawsuit: A claim arising from injuries or damages caused by a defective product manufactured or sold by the insured entity.

- Customer Injury: A claim made by a customer who suffers an injury within the insured business premises.

Process of filing liability insurance claims

The process of filing a liability insurance claim involves the following steps:

1. Notify the Insurance Provider: Inform the insurance company about the incident or claim as soon as possible.

2. Gather Information: Collect all relevant details, such as incident reports, witness statements, and any pertinent documentation.

3. Document Everything: Keep thorough records of the incident, including photographs and any related expenses.

4. Consult with the Insurance Agent: Seek guidance from the insurance agent regarding the specific procedures for resolving the claim.

Types of Health Insurance Claims

Explanation of health insurance claims

Health insurance claims encompass different types of requests for payment made by individuals or their healthcare providers to their insurance company. These claims are usually submitted after receiving medical treatment or services, and they can include a wide range of healthcare expenses, such as inpatient care, outpatient visits, planned surgeries, emergency treatments, and dental care.

Examples of health insurance claims

Examples of health insurance claims include inpatient claims for hospitalization, emergency claims for sudden medical interventions, outpatient claims for non-hospital treatments, and dental claims for oral health services. Additionally, there are cashless claims, where the insurer directly settles the bills with the healthcare provider, and reimbursement claims, where the individual pays for the services and then seeks repayment from the insurance company afterwards.

Process of filing health insurance claims

The process of filing health insurance claims involves submitting relevant documentation to the insurance provider, which outlines the details of the medical services received, along with associated costs. Once submitted, the insurance company reviews and processes the claim, determining the coverage and the amount to be reimbursed.

It is important to ensure that all necessary information is included and that the paperwork is filed promptly to expedite the claims process.

Types of Life Insurance Claims

Life insurance claims refer to the process through which beneficiaries file for the death benefits after the policyholder’s passing. These claims are a crucial aspect of life insurance, providing financial support to the deceased’s loved ones during a difficult time.

Types of Auto Insurance Claims

Explanation of auto insurance claims

Auto insurance claims refer to the process of seeking financial compensation from an insurance company to cover the costs resulting from an incident involving a insured vehicle. These incidents may include accidents, theft, vandalism, weather-related damages, and animal collisions.

Examples of auto insurance claims

Common examples of auto insurance claims include accident claims, windshield damage claims, theft and vandalism claims, animal damage claims, and weather-related claims. For instance, an individual may file a windshield damage claim after a rock chips or cracks their windshield while driving.

Process of filing auto insurance claims

When filing an auto insurance claim, it’s essential to gather all evidence and documentation related to the incident. The process typically involves contacting the insurance company, reporting the details of the accident, and providing the necessary documents to support the claim.

Additionally, speaking with an insurance adjuster is crucial, as they investigate to determine the compensation for the damages and injuries caused in the incident.

Types of Business Insurance Claims

Explanation of business insurance claims

Business insurance claims are requests made by businesses to their insurance providers for financial compensation or coverage for losses or damages incurred due to covered events such as theft, property damage, customer injuries, or product liability.

Examples of business insurance claims

- Burglary and Theft – Claims made for stolen property or assets.

- Water Damage – Claims for damages caused by flooding or water leaks.

- Customer Injuries – Claims arising from injuries sustained by customers on business premises.

- Product Liability – Claims related to injuries or illnesses caused by a business’ product.

Process of filing business insurance claims

- Contact Insurance Provider – Notify the insurance company about the incident.

- Gather Evidence – Collect all relevant evidence to support the claim, such as police reports, photographs, and damaged items.

- Review Policy – Understand the coverage and terms of the insurance policy to ensure eligibility for the claim.

- Submit Claim Form – Complete and submit the necessary claim forms along with the supporting documents.

- Evaluation – The insurance company assesses the claim, and if valid, compensates the business for the covered losses.

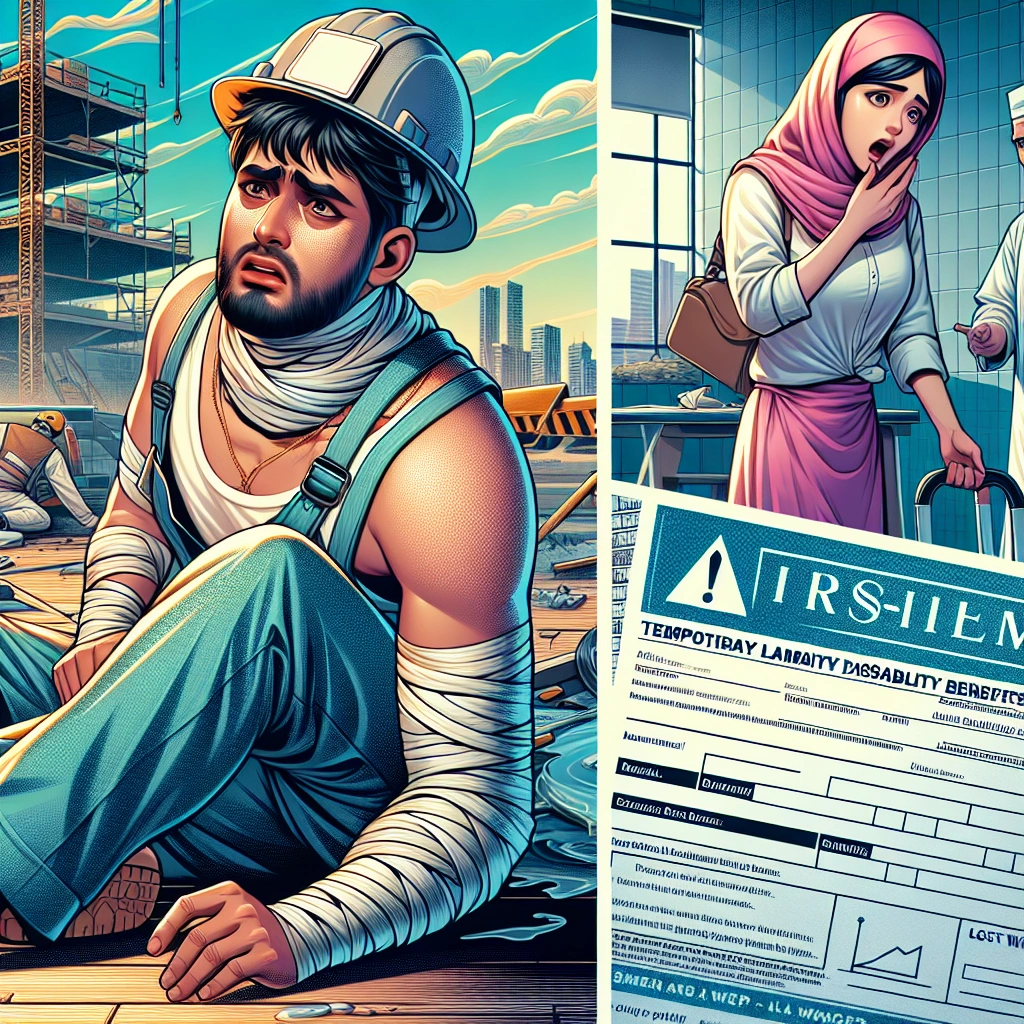

Types of Workers’ Compensation Claims

Explanation of workers’ compensation claims

Workers’ compensation claims are filed by employees who have sustained work-related injuries or illnesses. These claims are designed to provide financial assistance and benefits to cover medical expenses, loss of income, and rehabilitation services for the injured employees.

Examples of workers’ compensation claims

Examples of workers’ compensation claims include injuries such as back strains from lifting heavy objects, repetitive strain injuries from typing, carpal tunnel syndrome, slip and fall accidents in the workplace, and occupational illnesses caused by exposure to hazardous substances.

Process of filing workers’ compensation claims

The process of filing workers’ compensation claims typically involves the injured employee reporting the injury to their employer, completing necessary paperwork, seeking medical care for the injury, and then having the employer file a claim with the workers’ compensation insurance provider. The insurance company will then investigate the claim and make a decision on whether to approve or deny it.

| Type | Description |

|---|---|

| Type 1 – Medical Treatment Only | Involves medical treatment for work-related injuries or illnesses. |

| Type 2 – Medical Treatment with Lost Time from Work | Involves medical treatment as well as lost time from work due to the injury. |

| Type 3 – Disability Benefits | Provides benefits for partial or total disability resulting from a work-related injury. |

| Type 4 – Death Benefits | Provides financial assistance to the dependents of employees who have died as a result of a work-related injury or illness. |

Understanding the Claims Process

The importance of understanding the claims process lies in ensuring accurate and efficient processing, ultimately saving time and money. It provides clarity on the necessary steps to take when filing for an insurance claim and helps in avoiding potential complications or delays in the process.

Importance of understanding the claims process

It’s crucial to understand the claims process as it enables individuals to navigate through insurance claims efficiently. This understanding empowers them to provide the necessary documentation and information required, leading to a smoother and faster claims resolution.

Steps involved in filing an insurance claim

The steps in filing an insurance claim often include reporting the incident to the insurance provider, providing necessary documentation such as receipts or police reports, and communicating with an insurance adjuster to assess the claim’s validity and value.

Common issues with the claims process

Common issues in the claims process may include delays in communication with stakeholders, non-compliance with regulations, and challenges arising from inaccurate or missing data. It’s vital to address these issues to ensure a streamlined and effective claims process.

Statistics on Insurance Claims

Overview of statistics related to insurance claims

According to the Insurance Information Institute (III), in 2021, 5.3 percent of insured homes had a claim, with property damage accounting for 97.7 percent of homeowners insurance claims. Moreover, wind and hail damage comprised 45.5% of home insurance claims reported in 2020.

Trends in insurance claims

The insurance industry is witnessing a transformation towards ‘digital-first’ business models, unlocking new value worth billions of dollars. Furthermore, the industry has seen significant growth trends, as companies like Prudential Life and State Farm have dominated the market.

Impact of insurance claims on the insurance industry

Claims processing has been revolutionized with the use of photo apps, drones, and AI technologies to speed up claims assessment. Additionally, embracing sustainability goals as part of corporate governance is becoming vital, as it impacts the competitive position and reputation of insurance businesses.

Historical Facts About Insurance Claims

Evolution of insurance claims

The evolution of insurance claims has been influenced by significant historical events such as natural disasters, wars, and economic crises. These events have not only led to changes in the types of claims filed but have also shaped the insurance industry’s approach to risk assessment and coverage.

Impact of historical events on insurance claims

Historical events have had a profound impact on insurance claims, with large-scale disasters and unforeseen circumstances prompting insurers to reassess their underwriting practices and policy offerings. For example, the aftermath of the 9/11 attacks resulted in a shift towards terrorism insurance coverage and increased focus on risk mitigation strategies.

Notable insurance claim cases

Noteworthy insurance claim cases have ranged from the bizarre to the substantial. Instances such as the Kentucky resident who sued himself for bodily harm after being knocked unconscious by a boomerang demonstrate the peculiar nature of some claims.

On the other end of the spectrum, global disasters and accidents have led to some of the largest and most expensive insurance claims in history, underlining the diverse nature of insurance claims.

| Event | Impact |

|---|---|

| 9/11 attacks | Shift towards terrorism insurance coverage |

| Global disasters and accidents | Largest and most expensive insurance claims |

| Larry Rutman’s self-sued bodily harm case | Example of peculiar nature of some insurance claims |

Quotes About Insurance Claims

Insightful quotes from industry experts

- “Insurance is like marriage. You pay, pay, pay, and you never get anything back.” – Al Bundy

- “By 2030 more than half of current claims activities could be replaced by automation.” – McKinsey

- “AI and its related technologies will have a seismic impact on all aspects of the insurance industry, from distribution to underwriting and pricing to claims.” – McKinsey

Personal anecdotes related to insurance claims

- Once, a colleague described an insurance claim as an “endless paperwork nightmare,” highlighting the frustration many face when dealing with claims.

- A friend shared an experience where their insurance claim for a damaged car took months to process, causing significant inconvenience.

Humorous quotes about insurance claims

- “Insurance is like a parachute, it’s a pain unless it opens.” – Frank McKinney

- “Why did the insurance agency deny the high wire artist insurance? Because of her outstanding balance.” – Unknown

Importance of Properly Managing Insurance Claims

Impact of mismanaging insurance claims

Mismanaging insurance claims can lead to increased costs, delayed settlements, and dissatisfied customers. It can also result in reputational damage for insurance companies, as claimants may perceive the process as unfair and inefficient.

Benefits of effectively managing insurance claims

Effective management of insurance claims leads to cost savings, improved customer satisfaction, and streamlined processes. It also helps in detecting and preventing fraudulent claims, ensuring fairness and accuracy in settlements, and maintaining a positive brand image.

Strategies for proper claims management

- Utilize advanced fraud detection technology to identify and prevent fraudulent claims.

- Implement streamlined and efficient claims handling processes to reduce costs and improve customer experience.

- Focus on consistent communication to keep all parties informed throughout the claims process and maintain transparency.

- Embrace digitalization and automation to expedite claims processing and minimize errors.

| Effect | Description |

|---|---|

| Cost Savings | Efficient claims management reduces operational expenses and increases profitability. |

| Customer Satisfaction | Streamlined processes lead to faster settlements, enhancing customer experience. |

| Fraud Detection | Advanced technology helps in identifying and preventing fraudulent claims. |

| Brand Image | Proper claims management contributes to maintaining a positive brand reputation. |

Understanding the Role of Insurance Adjusters

Explanation of the role of insurance adjusters

Insurance adjusters play a crucial role in the insurance claims process by inspecting property damage or personal injury claims and evaluating the amount the insurance company should pay for the loss. This involves interviewing the claimant and witnesses, inspecting the property, and conducting thorough research, such as reviewing police reports.

Importance of insurance adjusters in the claims process

The importance of insurance adjusters in the claims process cannot be overstated. They are responsible for filing necessary paperwork, communicating with the claimant, and investigating the assignment of liability.

Their role is pivotal in ensuring a fair and accurate settlement for the claimant in the event of a loss.

Common misconceptions about insurance adjusters

Common misconceptions about insurance adjusters often paint their role as mundane and repetitive. However, the truth is far from this.

In reality, there are numerous complexities and challenges within the insurance claims process that make the role of insurance adjusters dynamic and multifaceted.

| Misconception | Reality |

|---|---|

| Insurance adjusters have a boring job | Their role is complex and challenging |

| Insurance adjusters minimize payouts | They aim for fair and accurate settlements |

| Public adjusters work like insurance company adjusters | Public adjusters have a unique role advocating for homeowners |

Common Misconceptions About Insurance Claims

Insurance claims can be surrounded by misconceptions that often lead to confusion and frustration. Let’s address some of the common misunderstandings about the claims process and specific types of insurance claims to bring clarity to policyholders and debunk some myths.

Debunking myths about insurance claims

One common myth about insurance claims is that filing a claim always leads to increased premiums. This misconception can deter individuals from filing legitimate claims.

In reality, not all claims result in increased premiums, especially those caused by uncontrollable events like natural disasters.

Clarifying misunderstandings about the claims process

Another prevailing myth is that insurance companies are reluctant to pay out claims. While some disputes may arise, the majority of claims are settled fairly and promptly.

It’s crucial to understand the terms of your policy and communicate effectively with your insurer to ensure a smoother claims process.

Common misconceptions about specific types of insurance claims

Specifically, with life insurance, there is a misconception that it’s only useful after the policyholder’s death. In truth, certain types of life insurance policies can provide living benefits, acting as a financial safety net during critical illness or disability.

| Myth | Debunked |

|---|---|

| Filing a claim guarantees premium increase | Not all claims lead to increased premiums |

| Insurance companies avoid paying out claims | Majority of claims are settled fairly and promptly |

| Life insurance is only useful after death | Certain policies offer living benefits |

Remember, the best way to navigate insurance claims is to stay informed, read your policy thoroughly, and seek clarification from your insurance provider when in doubt.

Recommended Amazon Products for Understanding Types of Insurance Claims

Here’s a curated list of products that can help you understand the different types of insurance claims with ease. These recommendations are based on usefulness, relevance, and positive reviews.

Insurance for Dummies, 6th Edition

This book covers a wide range of insurance topics, including the different types of insurance claims, making it a comprehensive resource for understanding insurance processes and procedures. Insurance for Dummies, 6th Edition is highly recommended for anyone seeking in-depth knowledge about insurance claims.

Accuform® Safety Sign

An Accuform® safety sign can be a helpful tool in preventing accidents or incidents, thereby reducing the frequency of liability insurance claims. The Accuform Safety Sign is recommended for businesses and individuals who prioritize safety and risk management.

TurboTax Premier 2021

For individuals dealing with property and business insurance claims, TurboTax Premier offers features that simplify tax filing, helping users optimize their claims and tax deductions. Consider using TurboTax Premier 2021 to help manage your insurance-related finances more effectively.

First Aid Only All-Purpose First Aid Kit

A versatile first aid kit like the First Aid Only All-Purpose First Aid Kit can be essential in handling minor health insurance claims by providing immediate care and documentation of injuries.

Ring Video Doorbell

For homeowners dealing with property and liability insurance claims, the Ring Video Doorbell offers enhanced security and peace of mind, potentially reducing the risk of property-related incidents.

Top Recommended Product for Understanding Types of Insurance Claims

If you’re looking for the best solution for understanding various types of insurance claims, we highly recommend Insurance for Dummies, 6th Edition. This comprehensive resource provides valuable insights into the claims process and is highly rated by readers.

| Pros | Cons |

|---|---|

| Comprehensive coverage | May be overwhelming for beginners |

| Highly informative | Not specific to one type of insurance |

| Well-reviewed |

Conclusion

Understanding different types of insurance claims is crucial for individuals to protect themselves financially in times of need. By knowing the specifics of each type of claim, individuals can ensure that they receive the coverage they are entitled to and avoid potential pitfalls in the claims process.

It is important for readers to be proactive in managing their insurance claims by keeping detailed records, understanding their policy coverage, and communicating effectively with their insurance provider. Being proactive can help individuals avoid delays and denials in the claims process, ultimately leading to a smoother and more efficient experience.

Seeking professional guidance when dealing with insurance claims can provide individuals with the expertise and support needed to navigate the complexities of the claims process. Insurance professionals can offer valuable insights and assistance in understanding policy language, negotiating with insurance companies, and ensuring that individuals receive fair and just compensation for their claims.