How Does W2 Work in 2023: A Complete Guide

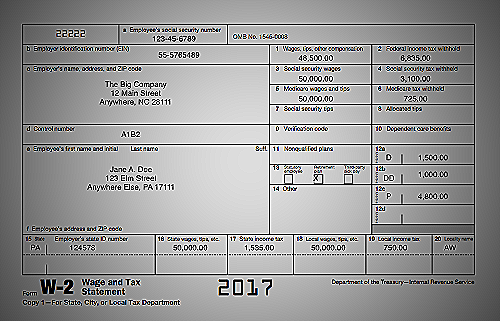

Form W-2 plays a vital role in determining your taxes and income as an employee. It contains important information regarding your earnings, taxes withheld, and other deductions.

In this guide, we’ll delve into how does W2 work and what you need to know about it.

According to the Internal Revenue Service (IRS, employers are required to prepare and distribute W-2 forms to their employees every year. The form outlines how much you’ve earned during the year and how much tax has been withheld.

Your employer must send a copy of your W-2 form to the Social Security Administration (SSA) as well. The W-2 form includes your Social Security number, name, and address, along with your gross income, taxes paid, and any deductions.

You’ll need this form to file your taxes and it’s important to check for any errors before submitting it. If you notice any mistakes on your W-2 form, notify your employer as soon as possible to avoid any issues with your taxes.

Now that we’ve covered the basics of W-2 forms, let’s dive deeper into how to get your form, filing requirements, and what to do if there are errors.

Check out this Youtube video to learn how to better understand your W2 tax form and take control of your finances: “Guide to the W2 Tax Form: Wages and Tax Statement – YouTube”.

What is a W-2 form?

A W-2 form is a crucial document that an employer is required to send to their employee at the end of the year. The form contains essential information about an employee’s income, such as their gross income for the year and the amount of taxes withheld from their salary, both federal and state taxes.

This document can also show other essential details about income, such as tips and other taxable stay. As an employee, this form is important because it helps during tax filing as it serves as proof of the income you earned and the amount of tax you paid to the state and federal government.

Therefore, it is important to have a copy of Form W-2 for every job you worked during the tax year.

[important message=’QWNjb3JkaW5nIHRvIHR1cmJvdGF4LmludHVpdC5jb20sIHRoZSBXLTIgZm9ybSBpcyBhIGNydWNpYWwgcmVmZXJlbmNlIHBvaW50IHdoZW4gZmlsaW5nIHRheGVzLCBhcyBpdCBhY2NvdW50cyBmb3IgYW4gZW1wbG95ZWUncyBhbm51YWwgaW5jb21lIGFuZCB0aGUgdGF4ZXMgdGhhdCB3ZXJlIGRlZHVjdGVkIGZyb20gdGhlaXIgcGF5LiA=’ color=’Ymx1ZQ==’]

How to get your Form W-2

To obtain your W-2 form, you need to contact your employer directly, who must provide it to you by January 31st. If you’ve moved houses in the past year, make sure to update your employer with your current address to avoid any delivery delays.

It is crucial to have your W-2 form in hand as it provides you with your annual income, the amount of tax deductions, and any tip-related information that the employer mentioned. You will need this document to file your taxes properly.

In case you are unable to acquire your W-2 from your employer, you can contact the Social Security Administration or the Internal Revenue Service for further assistance.

How a Form W-2 works

A Form W-2 is an important document that shows your annual income and the taxes that were deducted from your paycheck. It is usually prepared by your employer and provided to you by January 31st of each year.

The W-2 form includes your total wages, tips, and other compensation received from your employer. It also includes the amount of federal, state, and other taxes withheld from your paycheck, as well as contributions to your retirement plan, health insurance, and other benefits.

You need your Form W-2 to file your income taxes each year. It helps you report your income and calculate your taxes accurately.

If you don’t receive your W-2 form by February, you should contact your employer to request a copy. If you still don’t receive it, you can contact the IRS for assistance.

Self-employed individuals and independent contractors receive a different form called a 1099. This form is also used to report income to the IRS, but it includes different information than a W-2 form does.

Unlike a W-2 form, a 1099 form does not include information about taxes withheld from payments.

In summary, a W-2 form is a crucial document that shows your annual income and taxes withheld by your employer. It is important to keep copies of your W-2 form and other tax documents for at least three years, in case you need to refer to them in the future.

When should I receive my Form W-2 in 2023?

As an employee, you should have received your Form W-2 no later than January 31st, 2023, according to H&R Block. This document is crucial for filing your tax returns as it provides an overview of your annual earnings, taxes deducted, and tips.

Employers are legally obligated to send this tax form to both their workers and the Internal Revenue Service by the January deadline. In case you have not received your W-2, you can directly reach out to your employer to request the form.

It is important to make sure that your earnings throughout the year match what is reported on your W-2.

What to do if your W-2 is wrong

If you discover any errors on your Form W-2, it is important to act quickly. According to www.bing.com, you should first contact your employer to have any mistakes corrected as soon as possible.

If you’ve already filed your taxes and discover an error, you may need to file an amended return to correct the mistake.

It is important to note that you should have already received your Form W-2 from your employer no later than January 31st, 2023, as stated in www.hrblock.com. If you haven’t received your W-2 by then, you should ask your employer for it.

You may also find your W-2 online and have it made available at any H&R Block tax office through our database, according to the same source.

If you still cannot retrieve your W-2 from your employer, you can contact the IRS by dialing their toll-free number at 800-829-1040, as stated at www.irs.gov. Alternatively, you can schedule a visit to an IRS Taxpayer Assistance Center (TAC).

Afterward, the IRS may send a letter to your employer requesting a corrected Form W-2 which they’re obliged to furnish to you within ten days.

Always make sure that your W-2 contains accurate information about your yearly earnings and the total amount of taxes deducted during the previous tax year. Keep in mind that this document serves as a crucial reference point for filing tax returns, according to turbotax.intuit.com.

Your W-2 information is not a secret

According to the irs, W-2 information is not confidential and may be shared with them and state tax agencies. However, it is crucial to keep your W-2 and other tax documents in a safe place to protect your personal information from identity theft.

Your Form W-2 contains relevant information about your annual earnings, tax deductions, and benefits contributions, including your Medicare and Social Security payments.

What Is a W-4 Form? How to Fill Out an Employee’s Withholding Certificate

A W-4 form is a document that employees must complete to indicate how much federal income w tax to withhold from their paycheck. It allows the employee to adjust their withholding based on their filing status, income, deductions, and credits.

If the employee does not fill out a W-4 form, the employer must withhold taxes at the highest rate. Employees need to fill out a new W-4 form for each job they hold or if they experience a significant life change like marriage or birth.

How fica Tax Works in 2023

FICA tax refers to Social Security and Medicare taxes collected from employees and employers. In 2023, the Social Security tax rate is 12.4, with employees and employers each paying 6.2.

For Medicare, the total tax rate is 2.9, with employees and employers each paying 1.45. Self-employed individuals must pay both the employer and employee portions of fica taxes.

The thresholds for Social Security taxes may change every year, but Medicare taxes have no income limit.

Taxes on 401(k) Withdrawals & Contributions

A 401(k) is a workplace retirement account where you can make contributions and typically receive tax benefits. You do not pay taxes on the 401(k) contributions on your federal income tax return, reducing your taxable income.

However, when you withdraw money from your 401(k) in retirement, you will pay taxes on the withdrawals at your current tax rate. If you withdraw before age 59 ½, you may also have to pay an early withdrawal penalty.

It is essential to consult with a financial advisor to determine the best strategy for contributing to and withdrawing from your 401(k).

Conclusion

Knowing how W-2 works is essential for any employee who earns income. It is a vital document that summarizes your yearly earnings as well as the amount of taxes drawn from your paycheck and sent to the IRS.

Employers are legally obligated to send this tax form to both their workers and the Internal Revenue Service by January 31st of each year. To rectify any issues with your W-2 form, you can reach out to the IRS or schedule a visit to an IRS Taxpayer Assistance Center (TAC).

Additionally, it is your employer’s responsibility to ensure that you receive your W-2 form by the due date, but you can also retrieve it from your employer directly or find it online if needed.