What Is OASDI Tax in 2023?

Understanding OASDI Tax

What is OASDI Tax?

OASDI (Old-Age, Survivors, and Disability Insurance) tax is a payroll tax that funds the Social Security program. It is also known as the Social Security tax.

How OASDI Tax works

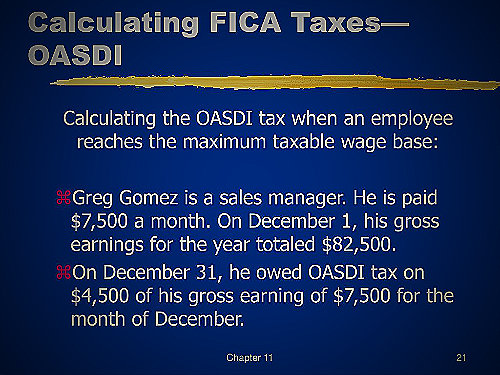

Employers are required to withhold OASDI tax from their employees’ paychecks. The tax is based on a percentage of the employee’s wages, up to a certain limit.

For 2021, the OASDI tax rate is 6.2% for both employees and employers, for a total of 12.4%. The tax only applies to wages below a certain amount, which is known as the Social Security wage base.

For 2021, the Social Security wage base is $142,800.

Definition of OASDI Tax

OASDI tax is a payroll tax that funds the Social Security program. It is based on a percentage of an employee’s wages and is subject to a yearly limit known as the Social Security wage base.

Check out this Youtube video to gain a better understanding of the OASDI Tax and its 4 most important points.

The OASDI Program and its Criteria

The Old-Age, Survivors, and Disability Insurance (OASDI) Program is a federal program designed to provide financial assistance to individuals who are retired, disabled, or the survivors of deceased workers.

It is managed by the Social Security Administration (SSA) and funded primarily through payroll taxes.

One of the criteria for the OASDI program is that workers must earn a certain number of credits to be eligible for benefits. Workers can earn up to four credits per year, and the number of credits needed to qualify for benefits depends on the individual’s age at the time they become disabled, retire, or die.

For example, a worker who becomes disabled before age 24 may qualify for benefits with only one and a half years of work (six credits), while a worker who retires at age 65 or later needs at least 40 credits (10 years of work).

Income earned by workers is subject to OASDI tax, which is used to fund the program. Employees pay 6.2% of their earnings up to a certain limit, while employers pay the equivalent of 6.2% of their employees’ earnings.

Self-employed individuals pay both the employee and employer portions of the OASDI tax. The annual limit on earnings subject to OASDI tax is $147,000 for 2022 and will increase to $160,200 in 2023.

This means that workers will pay a maximum of $9,932.40 into OASDI in 2022 and $10,079.40 in 2023.

What Does the OASDI Tax Fund?

The OASDI tax funds Social Security’s Old-Age, Survivors, and Disability Insurance program. This program provides benefits to retired, disabled, or deceased workers and their families.

The OASDI tax is used to fund Social Security benefits for individuals who have reached retirement age and individuals who become disabled, as well as their families. The funds collected from the OASDI tax are also used to provide survivor benefits to the families of workers who have passed away.

Additionally, the funds are used to pay for administrative expenses of the Social Security Administration, such as salaries, rent, and supplies.

OASDI Limit 2023 and Other Changes

The OASDI program sets a limit on the amount of earnings subject to taxation each year. This limit also applies when calculating benefits and changes annually with the national average wage index.

For 2023, the limit will be $160,200.

First implemented in 1937, workers pay into the OASDI program to fund Social Security through a tax levied at a rate of 6.2% for employees or 12.4% for self-employed individuals. The tax is levied on income up to the annual contribution and benefit base; up to $147,000 in 2022 and $160,200 in 2023.

Therefore, the maximum amount an employee can pay into OASDI in 2023 is $9,932.40.

In 2023, the OASDI tax rate remains unchanged at 6.2 percent for both employees and employers. The OASDI tax, commonly known as the “Social Security” tax, is part of the Federal Insurance Contributions Act (FICA).

Including the Medicare tax, which is also part of FICA, the total tax rate is 7.65% for employees and 15.3% for self-employed individuals.

Alternatives to Paying OASDI Tax

If you are looking for alternatives to paying OASDI tax or are interested in how to avoid paying OASDI tax, here are some options that you may want to consider:

Exemptions and Waivers from OASDI Tax

There are some exemptions and waivers available that may allow you to avoid paying OASDI tax. For example, some religious groups are exempt from the tax.

If you are a member of one of these groups, you will need to apply for an exemption with the IRS. Additionally, nonresident aliens may be exempt from the tax under certain circumstances.

Participating in a Retirement Plan

If you participate in a qualified retirement plan, such as a 401(k) or 403(b), you may be able to reduce the amount of income subject to OASDI tax. Your contributions to the plan are deducted from your gross income, lowering your taxable earnings and potentially reducing your tax liability.

Investing in Deferred Compensation Plans

Deferred compensation plans allow you to defer a portion of your income until a later date, potentially reducing your tax liability. These plans are typically offered by employers and may be subject to certain restrictions and limitations.

Working for an Employer Not Subject to OASDI Tax

If you work for a government agency or for an employer that is not subject to OASDI tax, then you may not be required to pay the tax.

While there are some alternatives and exemptions available, it may not be possible for everyone to avoid paying OASDI tax. It is important to review your individual situation and consult with a tax professional to determine the best course of action for your specific needs.

Conclusion

The Old-Age, Survivors, and Disability Insurance (OASDI) tax is a payroll tax that funds the Social Security program. It is paid by both employers and employees at a rate of 6.2%, up to a maximum earning of $160,200 for 2023.

The tax is part of the Federal Insurance Contributions Act (FICA) tax, which also includes the Medicare tax. The OASDI tax noted on your paycheck funds this comprehensive federal benefits program, which provides benefits to retired adults and people with disabilities.

References

- Social Security Administration – Contribution and Benefit Base

- IRS – OASDI and Medicare Tax Rates

- Investopedia – OASDI Tax