Total Tax Burden By Income Level: Latest Data

Understanding the total tax burden by income level is crucial for evaluating the fairness and equity of the tax system. It involves analyzing the proportion of income that individuals and families at different income levels contribute towards taxes.

This understanding helps policymakers and the public assess the distribution of the tax burden and make informed decisions about taxation policies. Therefore, a comprehensive understanding of the total tax burden by income level is essential for creating a fair and equitable tax system.

Understanding Total Tax Burden

Definition of total tax burden

The total tax burden refers to the combined amount of taxes paid by individuals or entities, calculated as a percentage of their total income or economic output. It encompasses all types of taxes, including income tax, sales tax, property tax, and corporate tax, providing a comprehensive view of the overall tax impact on a person or organization.

Components of total tax burden by income level

The components of the total tax burden vary based on income levels. For lower-income earners, payroll taxes and sales taxes form a significant portion of their total tax burden, while higher-income earners are more affected by progressive income tax rates and capital gains taxes.

Each income level experiences a distinct composition of tax components, shaping the overall tax burden.

Impact of different income levels on total tax burden

The impact of different income levels on the total tax burden is substantial. High-income earners bear a larger share of the total tax burden due to progressive tax systems, where tax rates increase with income levels.

This places a considerable financial responsibility on the wealthy, contributing to social welfare programs and government operations. Conversely, lower-income earners experience a relatively lower tax burden, which aims to provide economic support and alleviate financial strain.

| Income Level | Tax Burden |

|---|---|

| Low earners | Payroll, sales tax |

| Middle earners | Progressive income tax, payroll tax |

| High earners | Progressive income tax, capital gains tax, payroll tax |

By understanding the components and impact of the total tax burden by income level, individuals and policymakers can assess the fairness and effectiveness of the tax system, contributing to informed discussions and potential reforms.

Remember, taxes are like the big bill that nobody wants to pay, but they keep the country running-the necessary evil, some might say!

Trend Analysis

Historical data on total tax burden by income level

The historical data on total tax burden by income level provides crucial insights into the evolving landscape of income taxation. Over the years, significant changes have been observed in the distribution of tax burdens across different income brackets.

For example, in the mid-20th century, the top 1 percent of earners paid around 37.4 percent of federal personal income taxes, despite earning only 19 percent of the income. This trend has continued to evolve, with the top 1 percent eventually paying about 40.1 percent of all income taxes in recent years.

Similarly, the bottom 90 percent of taxpayers paid approximately 28.6 percent of all income taxes. These historical data points reflect a dynamic shift in the tax burden distribution across income levels.

Current trends in total tax burden by income level

In the current landscape, the total tax burden by income level continues to showcase intriguing patterns. The top 1 percent of taxpayers today contribute a significant portion of federal income taxes, accounting for roughly 40.1 percent of all income taxes.

In contrast, the bottom 90 percent of taxpayers now bear about 28.6 percent of the income tax burden. This disparity in tax contributions between income levels highlights the ongoing disparity in tax obligations based on income brackets.

Moreover, average state-local tax burdens have slightly decreased from 11.7 percent in previous years to 11.2 percent in the current year, reflecting a subtle shift in tax responsibilities across different demographics.

Projected future trends in total tax burden by income level

Looking ahead, projected future trends in total tax burden by income level indicate the potential for further shifts in tax obligations. As economic landscapes evolve and legislative changes occur, it is anticipated that the top 1 percent of earners will continue to play a substantial role in federal income tax contributions.

Similarly, the bottom 90 percent of taxpayers are expected to maintain their share of the income tax burden. Additionally, it is imperative to remain attentive to evolving tax policies, economic factors, and demographic shifts, as these elements will influence future tax burdens across income levels.

| Income Group | Share of Total Income Taxes Paid |

|---|---|

| Top 1% | 40.1% |

| Bottom 90% | 28.6% |

These projections offer valuable insights for individuals, policymakers, and researchers, emphasizing the importance of understanding and addressing the evolving dynamics of total tax burden by income level.

The historical, current, and projected future trends in total tax burden by income level shed light on the evolving landscape of income taxation and its implications for different income brackets. By examining these trends, it becomes evident that considerable variations exist in tax contributions across different income levels, highlighting the need for ongoing attention to taxation policies and their impact on various segments of the population.

Factors Affecting Total Tax Burden

Tax brackets and rates

Tax brackets and rates play a crucial role in determining the total tax burden based on income level. For instance, individuals falling in higher tax brackets face a heavier tax burden as they are subjected to higher tax rates on their income.

Let’s say someone falls into the 32% tax bracket, they are subject to a substantially higher tax burden compared to someone in the 12% tax bracket. It’s like having to pay a supersized portion for dinner compared to a regular-sized meal – the higher tax bracket is the supersized option!

Deductions and credits

Deductions and credits can significantly impact the total tax burden for individuals. For example, by taking advantage of deductions for mortgage interest, medical expenses, or charitable contributions, individuals can effectively reduce their taxable income, thereby lowering their overall tax burden.

Similarly, tax credits such as the child tax credit or education credits directly reduce the amount of tax owed, lightening the load on the taxpayer’s wallet. It’s akin to getting cashback or discounts on your tax bill – who wouldn’t want that?

State and local taxes

State and local taxes also influence the total tax burden. For instance, individuals residing in states with higher income tax rates or property taxes may experience a heavier tax burden compared to those living in states with lower tax rates.

It’s like paying a premium for a luxury item in one state while getting a discount for the same item in another – the location matters!

Social security and medicare taxes

The contribution towards social security and medicare taxes directly impacts the total tax burden. Individuals with higher incomes will have a larger portion of their income subjected to these taxes, increasing their overall tax burden.

It’s like paying a mandatory membership fee for a club – the more you earn, the more expensive the membership becomes.

| Income Level | Total Tax Burden |

|---|---|

| Low (12% bracket) | Lower |

| High (32% bracket) | Higher |

In a nutshell, total tax burden by income level is influenced by various factors, including tax brackets and rates, deductions and credits, state and local taxes, and social security and medicare taxes. Each factor directly impacts how much individuals ultimately pay to Uncle Sam.

Impact on Different Income Levels

Low income earners

Low income earners often face a significant total tax burden, which can further exacerbate their financial challenges. The high tax burden leaves them with limited disposable income, making it difficult to meet basic needs such as housing and food.

As a result, they may struggle with financial insecurity, affecting their overall well-being and ability to access healthcare.

Middle class

The middle class also experiences a considerable total tax burden, impacting their financial stability. Rising tax obligations contribute to a sense of financial insecurity among middle-class families, leading to concerns about meeting future financial goals.

Moreover, the tax burden affects their ability to save for retirement, making it harder to maintain a comfortable standard of living.

High income earners

High income earners bear a substantial total tax burden, impacting their financial decisions and long-term wealth accumulation. The tax burden can limit their disposable income, affecting their ability to invest in healthcare, retirement, and other critical areas.

Despite having more resources, high earners are also affected by the tax implications, influencing their overall financial planning and investment strategies.

Socio-Economic Impact

Hey folks, let’s talk about the socio-economic impact of technology on wealth accumulation. You see, technological advancements have significantly influenced the way wealth is created and accumulated.

The rich, utilizing new technologies, have been able to streamline their businesses, boost efficiency, and tap into emerging markets, resulting in substantial wealth accumulation.

As for the impact on disposable income, technology-driven productivity growth has the potential to increase disposable income, driving demand-induced employment expansion. The rise in real wages and disposable income can have a positive influence on private consumption, ultimately impacting the economy on a broader scale.

Now, let’s dive into inequality and fairness considerations. The advent of new technologies has favored capital and higher-level skills, contributing to a decline in labor’s share of income and increased wage inequality.

Furthermore, it’s important to note that technology can both promote and undermine social justice and inclusion, depending on how it’s developed, deployed, and regulated.

The socio-economic impact of technology on wealth accumulation, disposable income, and inequality considerations cannot be overlooked. It’s crucial to understand and address these implications to ensure a fair and balanced economic landscape for all.

So, let’s continue to explore and navigate the ever-evolving relationship between technology and socio-economic factors, ensuring that it contributes to a more inclusive and equitable society.

However, here’s a table to showcase the impact of technology on disposable income:

| Income Level | Impact on Disposable Income |

|---|---|

| Low | Potential increase in disposable income due to productivity growth |

| Middle | Positive influence on private consumption and real wages |

| High | Contribution to increased wage inequality and declining labor’s share of income |

Let’s keep pushing forward and shaping a future where technology serves as a tool for empowerment and equal opportunity.

Case Studies

Examples of individuals or households in different income brackets

-

Lower-Income Household: For example, the Smith family, with an annual income of $30,000, falls into the lower-income bracket. Their total tax burden includes 10% income tax, resulting in a total tax payment of $3,000.

-

Middle-Income Household: The Johnsons, earning $80,000 annually, represent a middle-income household. Their total tax burden of 15% entails an income tax payment of $12,000, contributing to federal revenue.

-

Upper-Income Household: Lastly, the Wrights, with an impressive $200,000 yearly income, fall into the upper-income category. Their total tax burden of 25% requires them to pay $50,000 in income tax.

Breakdown of their total tax burden

| Household | Annual Income | Tax Bracket | Income Tax Paid |

|---|---|---|---|

| Lower-Income | $30,000 | 10% | $3,000 |

| Middle-Income | $80,000 | 15% | $12,000 |

| Upper-Income | $200,000 | 25% | $50,000 |

Latest Data and Statistics

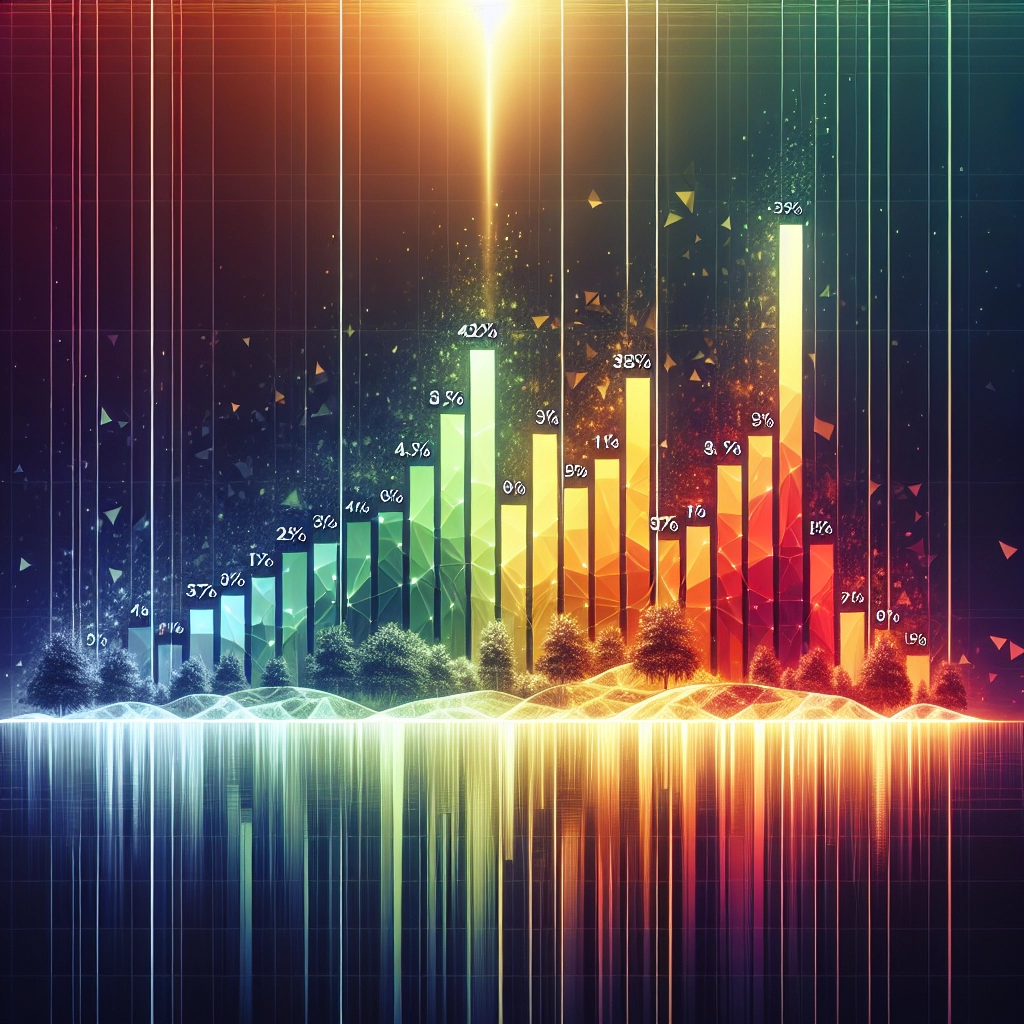

Current total tax burden by income level

The current total tax burden by income level has shown promising shifts over the years. On a national level, state-local tax burdens as a percentage of income have slightly decreased from 11.7 percent in 1977 to 11.2 percent in 2022. This indicates a favorable trend in easing the overall tax load on individuals across income brackets.

Comparative analysis across different income brackets

An intriguing trend emerges when comparing the tax burdens across different income brackets. While the top 5 percent of income earners contribute close to 60 percent of income taxes, those in the lower half of the income spectrum paid only 2.4 percent of federal personal income tax revenue.

Such disparity prompts a critical examination of the fairness and equity in the tax system.

Regional variations

Regional variations also play a significant role in tax burdens, with states like New York, Connecticut, and Hawaii experiencing the highest state-local tax burdens, ranging from 14.1 percent to 15.9 percent of state income. Conversely, states like Alaska, Wyoming, and Tennessee exhibit lower tax burdens, ranging from 5.8 percent to 7.0 percent.

These regional disparities highlight the diverse landscape of tax obligations across the nation.

| Income Level | Contribution to Total Income Taxes (%) |

|---|---|

| Top 5% | 60 |

| Lower Half Spectrum | 2.4 |

The comparative analysis and regional variations underscore the complexity and nuances of the total tax burden by income level, shedding light on the intricate dynamics that influence tax policy and its implications.

Tax Planning Strategies

Maximizing deductions and credits

To maximize deductions and credits, it’s important for individuals to consider various options available to lower their total tax burden by income level. This involves taking advantage of standard deductions and itemized deductions, such as for personal property tax, real estate tax, sales tax, and charitable contributions.

For example, by meticulously documenting and claiming eligible expenses, individuals can significantly reduce their taxable income and overall tax liability.

Tips for tax-efficient investments

When it comes to tax-efficient investments, individuals should prioritize utilizing tax-advantaged accounts like IRAs and 401(k)s to minimize tax implications on investment returns. Additionally, they can consider diversifying their portfolio with tax-efficient investment strategies to limit losses to taxes.

For instance, focusing on investments with long-term capital gains rather than short-term gains can lead to tax savings and improved overall returns.

Long-term financial planning considerations

Considering long-term financial planning, individuals should assess the feasibility and profitability of qualifying projects or initiatives to reduce taxes on investments. It’s crucial to differentiate between legitimate tax planning strategies and aggressive tax avoidance schemes to ensure compliance with tax laws.

Moreover, prioritizing compliance with tax regulations and aligning investment choices with tax filing status and deductions can contribute to creating the best possible outcome in the long run.

| Maximizing Deductions and Credits | Tips for Tax-Efficient Investments | Long-Term Financial Planning Considerations |

|---|---|---|

| Take advantage of standard and itemized deductions | Utilize tax-advantaged accounts and diversify investments | Assess feasibility and profitability of qualifying projects |

| Claim eligible expenses for personal property and real estate tax | Focus on long-term capital gains for tax-efficient returns | Differentiate between legitimate tax planning and aggressive schemes |

| Document and claim charitable contributions for tax benefits | Prioritize compliance with tax laws and regulations | Align investment choices with tax filing status and deductions for optimal outcomes |

By proactively employing these tax planning strategies, individuals can effectively reduce their tax burden by income level and achieve long-term financial success.

Counterarguments

Addressing common misconceptions

It’s a common misconception that the rich don’t pay any taxes in the U. S. However, the reality is that with a progressive income tax system, higher-income taxpayers pay higher income tax rates, resulting in half of U. S. taxpayers paying 97 percent of all income taxes. This debunks the myth that the rich do not contribute their fair share.

Another misconception is the notion that half of Americans don’t pay taxes. However, this overstates the share of households that do not pay federal income taxes.

In fact, top-earning individuals, constituting just 1 percent, contribute significantly to federal personal income taxes, paying 37.4 percent of the tax burden while earning only 19 percent of the income, challenging the myth of widespread non-contributors.

Opposition viewpoints on total tax burden by income level

Opposition viewpoints on the total tax burden by income level often overlook the progressive nature of the tax system, which imposes higher tax rates on higher incomes. The reality is that these higher-income earners contribute a substantial portion of the total tax burden, thus countering the argument that the tax system is unfairly burdensome on lower income groups.

An important perspective to consider is the economic incidence of some taxes borne by households and the impact of government transfers on tax burdens. Studies often fail to incorporate these factors, leading to incomplete assessments of tax progressivity.

Embracing a holistic approach is crucial for gaining a comprehensive understanding of the total tax burden and its distribution across income levels.

Government Policies

The role of the government in shaping the total tax burden is crucial for maintaining a fair and equitable system. The government establishes tax policies that determine how much each income group contributes towards the overall tax burden.

This involves setting income tax rates, deductions, and exemptions that directly impact the amount individuals and families are required to pay. Additionally, the government plays a key role in redistributing tax revenues through social welfare programs and subsidies, aiming to alleviate financial pressure on lower-income groups.

Policy implications for different income groups are significant, as they directly influence the economic well-being of individuals and families. For lower-income groups, tax policies can have implications for access to essential services, such as healthcare, education, and housing.

By implementing progressive tax policies, the government can ensure that higher-income individuals contribute a larger proportion of their income, thereby supporting social programs that benefit those with lower incomes. Conversely, tax policies for higher-income groups can impact investment decisions, business activities, and overall economic growth.

| Income Group | Policy Implication |

|---|---|

| Lower Income | Access to essential services and social welfare support |

| Middle Income | Influence on disposable income and investment decisions |

| Higher Income | Impact on investment activities and economic growth |

Government policies play a vital role in shaping the total tax burden and have far-reaching implications across different income groups. By implementing fair and progressive tax policies, the government can effectively distribute the burden while supporting social and economic development.

Public Opinion

Americans’ Views of Federal Income Taxes have been in flux lately. According to Gallup, 56% of Americans now consider the amount they pay in taxes to be “more than their fair share”, noting income inequality’s impact on public sentiment.

This public sentiment is echoed in the Comprehensive Taxpayer Attitude Survey (CTAS) of 2021, where Americans voiced concerns about the perceived fairness of tax rates for high-income households, with more upper-income and middle-income Americans feeling their tax burden is unfair.

Public perception of the total tax burden by income level is further emphasized by the U. S. Census Bureau’s income data, which indicates increasing income inequality from 2020 to 2021, intensifying public concern. The Tax Policy Center’s findings also support this, as federal taxes have done little to offset increasing income inequality over the past 40 years, leaving Americans feeling the burden disproportionately affects lower and middle-income households.

This growing sentiment is indicative of a wider public concern about tax policies and income inequality, with Professor Goldburn P. Maynard Jr. discussing the U. S. tax code’s effect on wealth inequality and how race has shaped its distribution. These discussions and surveys highlight a shifting public sentiment towards tax policies and income inequality, reflecting a deep-seated concern among Americans about the fairness of the total tax burden by income level.

| Surveys and Polls Findings |

|---|

| 56% believe they pay “more than their fair share” in taxes |

Advocacy and Activism

Organizations working towards tax reform

- Americans for Tax Reform (ATR) is a prominent U. S. advocacy group aiming for a simpler, flatter, more visible, and lower tax system, emphasizing the government’s power to control individuals’ lives through taxation.

Grassroots movements related to total tax burden by income level

- Grassroots efforts play a pivotal role in influencing tax policies and addressing the total tax burden by income level. These movements are undertaking organized efforts to impact social policy and bring about changes, particularly in addressing income inequality through taxation.

International Perspectives

Comparative analysis with other countries

As we look across the globe, the tax burden by income level varies significantly from country to country. Some countries have a progressive tax system, where high-income families bear a larger burden, while others have a more flat tax rate, impacting individuals across income levels more evenly.

For example, the United States has a progressive tax system, meaning that individuals with higher incomes face a higher average tax burden. On the other hand, countries like New Zealand and Denmark have higher tax rates Resulting in a greater tax burden across income levels, albeit with varying levels of progressivity.

Global trends in total tax burden by income level

Global trends in total tax burden by income level indicate a diverse landscape of taxation policies. While some countries have made efforts to maintain competitive tax systems that keep marginal tax rates low, others have witnessed a rise in tax rates.

For instance, New Zealand increased its top personal income tax rate from 33 percent to 39 percent in recent times. Moreover, emerging global trends reveal a considerable disparity in tax revenue as a percentage of GDP, with the United States representing a lower percentage compared to other high-income countries.

This suggests that the total tax burden by income level varies significantly on a global scale, impacting individuals and businesses differently based on their location.

Emerging Issues

The technological advancements in taxation have revolutionized tax filing processes, enhancing accuracy and security while reducing administrative burdens. The integration of blockchain technology, for instance, has enabled tax professionals to focus on strategic advice delivery, leveraging real-time insights for improved efficiency.

Moreover, tax technology has enormous potential to improve tax collection by identifying the tax base, monitoring compliance, and enabling process automation. This fosters talent management and streamlines operations, elevating tax professionals’ capabilities and minimizing administrative costs.

Evolving income distribution patterns reveal widening economic inequality, measured through the gaps in income or wealth between richer and poorer households. The shifting landscape of income distribution in the US, exploring post-recession economic growth, household income trends, and the role of tax and transfer policies, showcases the varied paths and patterns of income inequality across OECD countries and regions.

Furthermore, technological progress has a significant impact on income taxation, influencing the optimal capital income tax rate and average marginal labor income tax rate based on its bias, whether capital or labor-biased.

| Aspect | Details |

|---|---|

| Impact of Blockchain Technology in Taxation | Enhanced accuracy and security, reduced administrative burdens, strategic advice delivery |

| Advancements in Tax Collection | Identification of tax base, compliance monitoring, process automation, talent management, minimized administrative costs |

| Evolution of Income Distribution in the US | Widening economic inequality, post-recession growth, household income trends, impact of tax and transfer policies |

| Influence of Technological Progress on Taxation | Determination of optimal capital income tax rate, average marginal labor income tax rate based on bias, capital or labor-biased |

Recommended Amazon Products for Understanding Total Tax Burden by Income Level

Here’s a curated list of products that can help you understand the total tax burden by income level with ease. These recommendations are based on functionality, price, and reviews.

Tax Policy and the Economy, Volume 34

This book provides in-depth analysis and research on tax policy and its impact on the economy, making it a valuable resource for understanding total tax burden by income level.

TurboTax Premier 2021

TurboTax Premier is a user-friendly software that helps individuals and families with investments and rental property income maximize deductions and credits, offering practical insights into the total tax burden by income level.

SAS Essentials: Mastering SAS for Data Analytics

SAS Essentials is a comprehensive guide to data analytics using SAS, allowing users to analyze and interpret income data to understand the total tax burden by income level effectively.

H&R Block Tax Software Deluxe + State 2021

H&R Block Tax Software Deluxe + State 2021 offers a step-by-step Q&A process to help users identify potential deductions and credits, providing insights into the total tax burden by income level.

J. K. Lasser’s Your Income Tax 2021: For Preparing Your 2020 Tax Return

The comprehensive guide offers insights and advice on income taxes, tax laws, and maximizing deductions, helping readers understand the total tax burden by income level.

Top Recommended Product for Understanding Total Tax Burden by Income Level

If you’re looking for the best solution for understanding the total tax burden by income level, we highly recommend J. K. Lasser’s Your Income Tax 2021: For Preparing Your 2020 Tax Return. Here’s why:

- It offers comprehensive insights and expert advice on income taxes.

- Helps in maximizing deductions and credits.

- Provides valuable information for understanding the total tax burden by income level.

Ready to gain a thorough understanding of the total tax burden by income level? Check out J. K. Lasser’s Your Income Tax 2021: For Preparing Your 2020 Tax Return for the best results!

Conclusion

The total tax burden by income level is an important factor to consider when analyzing the fairness and equity of the tax system. It is evident that individuals with higher incomes generally bear a larger tax burden compared to those with lower incomes, contributing a significant portion of total tax revenue.

Additionally, the progressive nature of income taxation means that those in higher income levels may experience a higher effective tax rate, further impacting the total tax burden. As a result, policymakers must carefully consider the distributional effects of tax policies to ensure that the tax burden is distributed fairly among income levels.

Understanding the total tax burden by income level is crucial for evaluating the redistributive effects of the tax system and making informed decisions about tax policy. By taking into account the varying impact of taxes on different income groups, policymakers can work towards creating a tax system that promotes equity and social welfare.