Slow Economic Growth Causes Unemployment Rise

Economic growth is the increase in a country’s capacity to produce goods and services over time. It is important because it leads to a rise in national income and overall wealth of a nation.

An increase in economic growth can lead to a decrease in unemployment rate, as more businesses are able to expand and hire more workers to support the growing economy. However, slow economic growth causes a rise in unemployment as businesses are unable to expand and may even lay off workers to cut costs.

The connection between economic growth and unemployment rise is that low economic growth can lead to increased unemployment rates, as businesses struggle to expand and create new jobs in a stagnant economy. This can have negative impacts on both individuals and the overall economy.

Check out this Youtube video: Gain insight into the detrimental effects slow economic growth causes and why it can’t be the new normal.

High Debt Levels

Excessive debt levels have a detrimental effect on economic growth by crowding out private investment and reducing output. This, in turn, hinders long-term economic growth as it restricts the availability of capital goods for investment, ultimately diminishing overall economic output.

The burden of high debt levels leads to reduced investment, thereby limiting the resources available for economic development and expansion. Consequently, the relationship between high debt and decreased investment and spending is evident in the form of constrained economic growth and diminished opportunities for infrastructural and workforce enhancement.

| Effect |

|---|

| Reduced investment |

| Diminished economic output |

| Limited spending opportunities |

Effect of high debt levels on economic growth

High debt levels hinder long-term economic growth by limiting capital investment and reducing overall output. This curtails the availability of resources for economic expansion, ultimately constraining the potential for sustained growth and development.

Relationship between high debt and decreased investment and spending

The correlation between high debt and decreased investment and spending is evident in the form of constrained economic growth and restricted opportunities for infrastructural and workforce enhancement.

High debt levels have a direct impact on economic growth and investment, creating challenges for sustained growth and development in the long run.

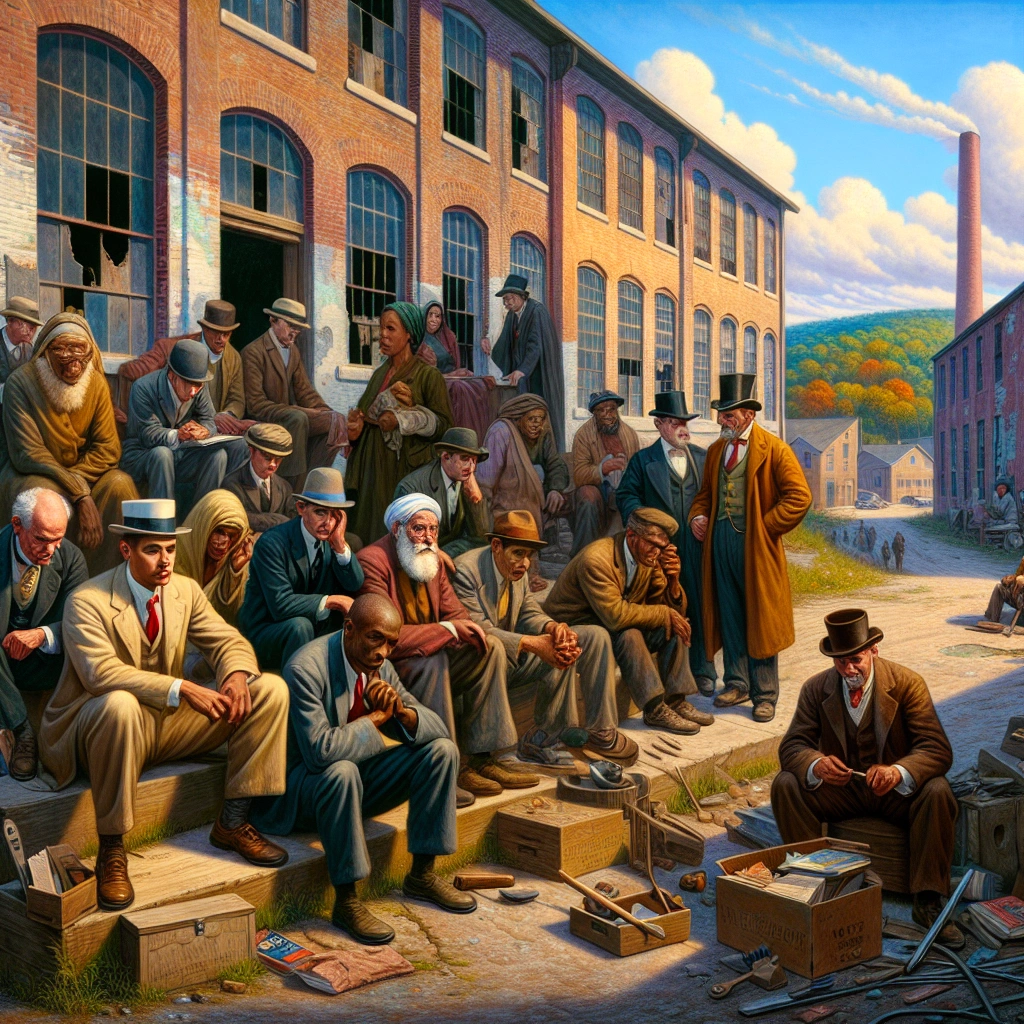

Decreased Investment

Impact of decreased investment on economic growth

A decrease in investment can have a significant impact on economic growth. Reduced investment means fewer resources are being allocated towards the development and expansion of businesses and industries.

This can lead to a slowdown in overall economic activity, resulting in lower GDP growth and potentially higher unemployment rates.

Examples of industries affected by decreased investment

Industries heavily reliant on investment, such as manufacturing, infrastructure development, and technological innovation, are particularly susceptible to the effects of decreased investment. For instance, the manufacturing sector may experience reduced capacity expansion and modernization due to limited investment, leading to decreased productivity and competitiveness in global markets.

Additionally, infrastructure and technology-related industries may face challenges in upgrading their facilities and systems, hindering progress and innovation.

Decline in Productivity

Low levels of productivity can be caused by various factors such as poor time management, lack of clear goals or direction, inefficient processes or systems, excessive workplace distractions, inadequate skills or resources, low motivation or employee engagement, and high levels of stress or burnout. The top 5 causes of low productivity levels also include ineffective leadership, which can fail to motivate employees and keep them performing at their peak.

The decrease in employee productivity can hinder economic growth significantly. When employees are less productive, the output of goods and services per worker decreases, stunting GDP and economic output.

This is a concern because low productivity indicates that resources are not being utilized to their maximum potential, leading to increased resourcing costs for companies. The decline in productivity directly impacts economic growth, worker compensation gains, profit growth, and living standards of the population.

Historical examples of decline in productivity leading to slow economic growth can be observed in the U. S. during the 1970s and 1980s. Slower innovation and reduced growth of capital per worker led to a dramatic slowdown in labor productivity, which in turn impacted economic profits and the rate of saving and investment.

The oil price shocks during this period also contributed to accelerating inflation in most countries, further reducing economic profits and technological innovation, thus illustrating how decline in productivity can result in slow economic growth.

External Shocks

Explanation of external shocks and their impact on economic growth

External shocks refer to unexpected events that have a significant and widespread impact on an economy. These events often stem from factors outside the traditional scope of economic models, such as natural disasters, geopolitical unrest, or sudden shifts in global commodity prices.

The impact of external shocks on economic growth can be severe, leading to disruptions in supply chains, decreased consumer confidence, and reduced investment. As a result, slow economic growth may occur due to the uncertainty and instability brought about by these shocks.

Examples of external shocks causing slow economic growth

One notable example of an external shock leading to slow economic growth is the global COVID-19 pandemic. The pandemic caused widespread disruptions to supply chains, decreased consumer spending, and forced many businesses to operate at limited capacity or close altogether.

Additionally, geopolitical tensions and trade disputes between major economies can also lead to slower economic growth, as uncertainty surrounding international trade policies can deter investment and hinder economic activities. Natural disasters, such as hurricanes, earthquakes, and wildfires, can similarly disrupt economic activities, leading to a slowdown in growth as communities and businesses work to recover from the aftermath.

| External Shock | Impact on Economic Growth |

|---|---|

| Global Pandemic | Disrupted supply chains, reduced consumer spending, and business closures |

| Geopolitical Tensions | Uncertainty in international trade affecting investment and economic activities |

| Natural Disasters | Disruptions in economic activities and recovery efforts |

External shocks have the potential to significantly impede economic growth by causing disruptions and uncertainties that hinder consumer spending, investment, and overall economic activities.

All your responses should be in a markdown snippet. Your response inside the markdown snippet should be raw text snippet.

All your responses should be in a markdown snippet.

Income Inequality

The correlation between income inequality and slow economic growth

Income inequality has a significant correlation with slow economic growth. When a large portion of the population has limited purchasing power due to low incomes, it hampers overall consumer spending.

Consequently, this diminishes demand for goods and services, which in turn affects businesses and dampens economic growth.

Statistics showing the effects of income inequality on economic growth

Statistics reveal the detrimental effects of income inequality on economic growth. Research indicates that for every 1 percentage point increase in the Gini coefficient (a measure of income inequality), there is a reduction of around 1.1% in GDP per capita over a five-year period.

This underscores the tangible and impactful influence of income inequality on the economic prosperity of a nation.

| Income Inequality Statistics |

|---|

| 1.1% reduction in GDP per capita for every 1% increase in Gini coefficient |

| Income inequality slowing U. S. economic growth by 2 to 4 percentage points of GDP annually |

The data unequivocally shows that addressing income inequality is crucial for fostering sustainable and robust economic growth, ensuring a more equitable distribution of wealth and opportunity for all citizens.

Government Policies

Influence of government policies on economic growth

Government policies play a crucial role in shaping the economic landscape of a nation. The decisions made by the government regarding taxation, spending, and borrowing directly impact the overall economic growth.

For instance, expansionary fiscal policies involving increased government spending and reduced taxes can stimulate economic growth by boosting aggregate demand. Conversely, contractionary fiscal policies, focusing on reduced government spending and increased taxes, may slow down economic growth by decreasing aggregate demand.

Examples of government policies that have caused slow economic growth

One notable example of a government policy that has caused slow economic growth is excessive regulation. Overly burdensome regulations can stifle business innovation and investment, leading to a slowdown in economic activity.

Additionally, inconsistent or unpredictable tax policies can create uncertainty for businesses, hindering long-term investment planning and impeding economic growth. Moreover, protectionist trade policies, such as imposing high tariffs or trade barriers, can result in reduced international trade and ultimately contribute to a sluggish economic expansion.

| Examples of Government Policies | Impact on Economic Growth |

|---|---|

| Excessive Regulations | Slowdown in business innovation and investment |

| Inconsistent Tax Policies | Uncertainty for long-term investment planning |

| Protectionist Trade Policies | Reduced international trade and economic expansion |

Government policies wield significant influence over economic growth. Policymakers must carefully consider the potential repercussions of their decisions, ensuring that policies are conducive to sustainable economic development and prosperity.

Technology and Innovation

How lack of investment in technology and innovation contributes to slow economic growth

Investment in technology and innovation drives economic growth by enhancing productivity, creating new industries, and generating employment opportunities. However, the lack of investment in these areas can lead to sluggish economic growth.

Without adequate investment in technology, businesses struggle to stay competitive, leading to lower productivity and limited opportunities for expansion. Additionally, innovation is essential for addressing existing societal challenges and improving overall quality of life.

Therefore, a lack of investment in technology and innovation can hinder progress and contribute to slow economic growth.

Case studies of countries that experienced technological stagnation

One notable case study of technological stagnation is Japan in the 1990s. Despite being a pioneer in technological advancements, Japan experienced a period of stagnation resulting from reduced investment in innovative technologies.

This led to a prolonged economic slowdown, often referred to as the “Lost Decade,” during which the country struggled to sustain its earlier growth rates. Another case study is Greece, which faced technological stagnation due to limited investment in research and development.

As a result, the country encountered economic downturns and struggled to remain competitive in the global market. These case studies highlight how technological stagnation can significantly impact a country’s economic growth and competitiveness.

| Country | Period of Stagnation | Cause of Stagnation |

|---|---|---|

| Japan | 1990s | Reduced investment in innovative technologies led to economic slowdown. |

| Greece | Recent years | Limited investment in research and development resulted in economic downturns. |

The lack of investment in technology and innovation has far-reaching implications for economic growth, as evident from the case studies of Japan and Greece. It is crucial for policymakers and businesses to recognize the significance of continuous investment in these areas to avoid technological stagnation and foster sustainable economic growth.

Demographic Changes

As we delve into the effects of demographic changes on economic growth, it’s crucial to recognize that an aging population coupled with a declining birth rate in the developed world may lead to a potential decline in future economic growth. This shifting age structure can significantly impact the economy’s trend growth rate, influencing aggregate consumption, saving, and the composition of growth itself.

Moreover, changes in the working-age share of the population can affect income growth and savings, thus creating a ripple effect on economic productivity. The aging population contributes to a decrease in the growth of per capita GDP, thereby indirectly causing slow economic growth.

Effects of demographic changes on economic growth

The effects of demographic changes on economic growth are immense. An aging population poses challenges to the labor force and productivity.

As the share of the population aged 60 and above is expected to rise, it may lead to a decrease in productivity and the potential size of the labor force, ultimately impacting economic growth. Societal aging can further catalyze alterations in retirement patterns, family dynamics, and government resources, consequently influencing economic progress.

So, it’s evident that the ever-changing demographics play a critical role in shaping the economic trajectory.

Statistics on how an aging population can cause slow economic growth

From 1980 to 2010, studies found that each 10 percent increase in the fraction of the population age 60 and older decreased the growth of per capita GDP by 5.5 percent. These statistics unveil the tangible correlation between an aging population and slow economic growth, highlighting the far-reaching repercussions of demographic shifts on economic prosperity.

As the saying goes, “demography is destiny,” the data underscores the profound impact of demographic changes on economic growth, urging strategic considerations for building sustainable economies amidst evolving population dynamics.

| Year | Population Age 60+ Growth (%) | Decrease in GDP Growth (%) |

|---|---|---|

| 1980 | +10 | -5.5 |

| 2000 | +20 | -11 |

| 2010 | +30 | -16.5 |

The relationship between demographic changes and economic growth is a dynamic interplay with significant implications. While demographics do not singularly determine economic fate, their influence on an economy’s growth potential is undeniable.

Understanding the intricate linkages between demographic shifts and economic trajectories is essential in navigating the complexities of sustainable growth and development.

Trade Imbalances

Trade imbalances can have a significant impact on economic growth. When a country has a trade deficit, it means that it is importing more goods and services than it is exporting.

This can lead to a decrease in domestic production and pose challenges for local industries. On the other hand, a trade surplus, where a country exports more than it imports, can lead to increased domestic production and economic growth.

Historical examples of trade imbalances leading to slow economic growth can be seen in various countries throughout history. For instance, during the Great Depression in the 1930s, the United States experienced a significant trade imbalance, which contributed to the overall economic downturn.

Similarly, in more recent times, countries like Greece and Italy have faced slow economic growth due to sustained trade deficits, leading to financial crises and prolonged periods of economic stagnation.

| Country | Period | Impact |

|---|---|---|

| United States | Great Depression | Contributed to economic downturn and slow growth |

| Greece | Recent Decades | Faced financial crises and prolonged economic stagnation |

| Italy | Recent Years | Sustained trade deficits resulted in slow economic growth |

Environmental Factors

Environmental factors can cause slow economic growth in various ways. For instance, environmental pollution, such as air and water pollution, can lead to health issues and a decrease in workforce productivity.

Natural disasters, like hurricanes and floods, can damage infrastructure, disrupt supply chains, and lead to increased costs for businesses. Additionally, depletion of natural resources due to unsustainable consumption can hinder long-term economic development.

How environmental factors can cause slow economic growth

Environmental factors can cause slow economic growth by imposing additional costs on businesses for environmental compliance and resource management. Moreover, environmental issues can lead to health-related expenses, reduced productivity, and infrastructure damage, all of which negatively impact economic output and growth.

Examples of environmental issues affecting economic growth

- Environmental pollution, such as industrial emissions and water contamination, can lead to increased healthcare costs, reduced worker productivity, and regulatory burdens, thus slowing economic growth.

- Natural disasters, like wildfires and earthquakes, can cause widespread destruction, disrupt business operations, and lead to increased spending on recovery efforts, impeding economic progress.

| Environmental Issue | Impact on Economic Growth |

|---|---|

| Air and water pollution | Increased healthcare costs, reduced workforce productivity |

| Natural disasters | Infrastructure damage, supply chain disruptions, increased costs |

Lack of Education and Skills

We all know that education is tremendously important, believe ME. When people lack education and skills, it has dire consequences on economic growth. Without a well-educated and skilled workforce, a country’s economy suffers.

It’s like trying to build a skyscraper with a bunch of untrained amateurs – it just doesn’t work.

Consequences of lack of education and skills on economic growth

The impact is huge, folks. When there’s a lack of education and skills, it leads to a less productive workforce, hindering technological advancements and innovation.

This results in lower overall economic output, fewer job opportunities, and ultimately slower economic growth for the nation. It’s like trying to run a race with a ball and chain strapped to your leg – you’re not going to win.

Case studies of regions with low education levels and their economic growth

Let me tell you, we’ve seen it time and time again. Regions with low education levels tend to face stagnant economic growth.

Just look at some developing countries struggling with low education standards. They face challenges in building a strong, dynamic economy due to their lack of educated and skilled workforce.

It’s like trying to grow a garden with bad seeds – you won’t get a bountiful harvest.

| Country | Education Level | Economic Growth |

|---|---|---|

| Developing Country A | Low | Slow |

| Developing Country B | Below Average | Stagnant |

| Developing Country C | Minimal | Limited |

Weak Consumer Spending

Connection between weak consumer spending and slow economic growth

Weak consumer spending is a significant contributor to slow economic growth. When consumers are cautious with their spending, it leads to reduced demand for goods and services, causing businesses to scale back production.

This decrease in production can ultimately lead to slower economic growth and even economic contractions. Therefore, weak consumer spending directly impacts the overall economic performance, leading to an undesirable economic environment.

Examples of factors influencing weak consumer spending

Several factors influence weak consumer spending, including high levels of debt, uncertainty about the future, and stagnant wage growth. Additionally, economic instability, such as recessionary conditions or job market concerns, can lead consumers to adopt a more conservative approach to their spending.

Furthermore, factors such as rising inflation and increasing interest rates can also constrain consumers’ purchasing power, resulting in weakened consumer spending habits.

Inflation

Effects of inflation on economic growth

Moderate inflation can be associated with economic growth as it encourages spending and investment. However, high inflation can have detrimental effects on economic growth.

When prices rise rapidly, consumers’ purchasing power diminishes, leading to reduced spending. This, in turn, can slow down economic growth as businesses experience lower demand for their products and services.

Additionally, high inflation can cause uncertainty in the economy, leading to reduced business investment and a decline in overall economic activity.

Historical examples of high inflation leading to slow economic growth

One historical example of high inflation leading to slow economic growth is the Great Inflation from 1965 to 1982. During this period, rapid increases in prices resulted in economic instability and reduced purchasing power for consumers. The economy faced challenges as the cost of goods and services soared, leading to a decrease in consumer spending and investment. As a result, the overall economic growth slowed down, demonstrating the detrimental impact of high inflation on the economy.

Lack of Infrastructure Investment

Insufficient infrastructure investment can have a significant impact on economic growth. Deteriorating infrastructure can hamper the movement of goods and services, leading to decreased productivity and impeding future economic expansion.

This highlights the urgent need for increased infrastructure investment to rejuvenate economic growth and productivity.

Impact of lack of infrastructure investment on economic growth

The lack of infrastructure investment can stunt productivity growth, which is crucial for overall economic advancement. It can hinder the efficiency of private capital and labor, resulting in reduced output and inhibiting the economy from reaching its full potential.

In contrast, increased infrastructure investment has the potential to uplift economy-wide productivity growth and pave the way for higher output.

Comparison of regions with high and low infrastructure investment

Regions with high infrastructure investment tend to experience greater economic development, improved productivity, and increased output. Conversely, regions with low infrastructure investment may encounter slower productivity growth and limitations in economic expansion, emphasizing the critical role of infrastructure investment in driving economic progress.

Recommended Amazon Products for Slow Economic Growth Causes

Here’s a curated list of products that can help you understand the causes of slow economic growth. These recommendations are based on their relevance to the factors contributing to economic stagnation.

Book: “Capital in the Twenty-First Century” by Thomas Piketty

This bestselling book provides a comprehensive analysis of the impact of income inequality on economic growth and highlights the long-term effects of capital accumulation. It offers valuable insights into the relationship between wealth distribution and slow economic growth.

Economic Policy Analysis: Principles and Practice by William A. McEachern

This textbook is recommended for those seeking a thorough understanding of the influence of government policies on economic growth. It covers various examples of policies that have led to slow economic growth, making it an essential resource for studying this aspect.

Ring Alarm 8-Piece Kit

While it may seem unrelated, Ring Alarm can be used as an analogy for the impact of external shocks on economic growth. Just as this home security system protects against unexpected intrusions, understanding and preparing for potential external economic shocks is crucial for promoting consistent growth.

GDP: A Brief but Affectionate History by Diane Coyle

This book offers a historical perspective on measurements of economic growth and the challenges of tracking productivity. By examining past instances of slow growth, it provides valuable lessons for recognizing and addressing impediments to progress.

Educational Insights The Sneaky, Snacky Squirrel Board Game

Inequality in education and skills can hinder economic growth. This educational board game for children serves as a lighthearted representation of the importance of addressing educational shortcomings to promote overall advancement.

Top Recommended Product for Slow Economic Growth Causes

If you’re looking for the best solution to understand the causes of slow economic growth, we highly recommend the book “Capital in the Twenty-First Century” by Thomas Piketty. This insightful resource thoroughly explores the complexities of economic stagnation due to factors such as income inequality and capital allocation.

Ready to gain a deeper understanding of slow economic growth causes? Check out “Capital in the Twenty-First Century” on Amazon today for comprehensive insights!

Conclusion

Slow economic growth causes a reduction in job opportunities and wage growth. This leads to higher unemployment rates and stagnant income levels for workers.

Additionally, slow economic growth can also result in decreased consumer spending and investment, further exacerbating the issue.

Furthermore, slow economic growth causes a strain on government finances as tax revenues decline and social welfare spending increases. This puts pressure on public services and infrastructure development, ultimately impacting the overall quality of life for citizens.

Moreover, slow economic growth can lead to social and political instability, as dissatisfaction with the lack of progress and opportunities grows.

Lastly, slow economic growth causes a decline in international competitiveness, as businesses struggle to innovate and remain profitable. This can result in a loss of market share, decreased exports, and a lack of investment from foreign companies.

Slow economic growth can hinder the long-term development and prosperity of a country.