Copay vs Deductible: Which One Saves You More Money?

Health insurance can be difficult to navigate, especially when it comes to understanding two of the most common yet confusing terms: copay and deductible. In this article, we will discuss the differences between copay and deductible, and which one will save you more money in the long run.

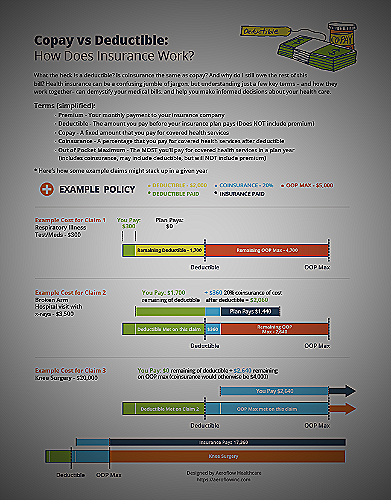

Check out this informative Youtube video about copays vs deductibles, which will help you gain a better understanding of premiums, deductibles, copays, and out-of-pocket maximums related to healthcare expenses!

When it comes to health insurance, it’s important to understand the difference between copays and deductibles. A copay is a fixed amount paid out of pocket for medical services or prescription drugs at the time of service, while a deductible is the amount that must be paid before the insurance plan starts covering defined benefits.

According to MetLife and eHealthInsurance, both copays and deductibles are out-of-pocket expenses that policyholders need to consider.

Key Differences: Copay vs Deductible

Copays

Copays are a fixed fee that you pay out-of-pocket for specific healthcare services or prescription drugs covered by your insurance plan. For example, if your plan has a $20 copay for each visit to your primary care physician, you will pay $20 at each visit.

Copays do not count towards your deductible or maximum out-of-pocket expenses. It’s important to understand the difference between copay vs deductible, as deductibles are the predetermined amount you need to pay before your insurance provider starts covering your expenses.

Deductibles

A deductible is the amount you have to pay out of pocket before your insurance starts to cover defined benefits. This is the initial payment you need to make before your insurance company starts covering the costs.

After you reach your deductible, your insurance starts to cover defined benefits. Deductibles reset annually, which means you have to meet the deductible each year.

According to www.metlife.com, deductible is one term that often comes up in health insurance. It is essential to understand the terminology to choose the right health insurance plan for you.

Coinsurance

Coinsurance is the percentage of the total cost of a medical service or prescription drug that you’re required to pay after you’ve met your deductible. This means that the insurance company pays a portion of the cost while you pay the remaining percentage.

The coinsurance rate varies depending on your insurance plan. For example, if your insurance plan has a 20% coinsurance rate for hospitalization, you would be responsible for paying 20% of the total cost of your hospitalization after you’ve met your deductible.

A deductible is the sum of money that you must pay upfront for covered services during a plan year before your insurance provider takes over. On the other hand, a copay is a fixed amount of money that you pay for specific covered services.

Copays are typically smaller and paid more frequently, whereas deductibles are more substantial but required only once a year (unless you are a Medicare beneficiary, where it applies to each benefit period instead of on a calendar year basis).

Similarities between Copays and Deductibles

Copays and deductibles share some similarities as they are both out-of-pocket expenses paid for by the individual. Copays involve paying a fixed amount for healthcare services or prescription drugs, while deductibles are the amount that needs to be paid out of pocket before the insurance company starts covering the defined benefits.

The amount for both copays and deductibles can vary depending on the health insurance plan chosen by the individual. It is essential to consider these differences when selecting a health insurance plan.

Which One Saves You More Money?

The answer to this question depends on your individual healthcare needs and your health insurance plan. If you require frequent medical visits or prescription drugs, a copay plan may be the better option for providing predictable out-of-pocket costs.

However, if you do not require regular medical services or prescription drugs, a high-deductible health plan may save you money in the long run.

Ultimately, it is important to carefully review and compare different health insurance plans to determine which one best fits your specific needs and budget. You should also consider consulting with a licensed insurance agent or healthcare provider to help you make an informed decision.

Conclusion

Understanding the differences between copays and deductibles is essential in managing healthcare costs and choosing the right insurance plan. Copays are fixed amounts paid by the patient for each visit or service, while deductibles are out-of-pocket expenses that must be paid before insurance coverage begins.

While one may be more advantageous than the other, depending on individual healthcare needs and financial situation, having a solid understanding of both can be beneficial in making informed decisions about healthcare.

References

- Healthline: Copay vs Deductible: Understanding What They Are And Which One Is Right For You

- PGEgaHJlZj0iaHR0cHM6Ly93d3cuYmNic20uY29tL2luZGV4L2hlYWx0aC1pbnN1cmFuY2UtaGVscC9mYXFzL3RvcGljcy9ob3ctaGVhbHRoLWluc3VyYW5jZS13b3Jrcy93aGF0LWRpZmZlcmVuY2UtYmV0d2Vlbi1jb3BheW1lbnQtZGVkdWN0aWJsZS1jb2luc3VyYW5jZS5odG1sIiB0YXJnZXQ9Il9ibGFuayI+Qmx1ZSBDcm9zcyBCbHVlIFNoaWVsZCBvZiBNaWNoaWdhbjogV2hhdCdzIHRoZSBEaWZmZXJlbmNlIEJldHdlZW4gQ29wYXltZW50LCBEZWR1Y3RpYmxlIGFuZCBDb2luc3VyYW5jZT88L2E+

- PGEgaHJlZj0iaHR0cHM6Ly93d3cubWVkaWNhcmUuZ292L2dsb3NzYXJ5L2RlZHVjdGlibGUiIHRhcmdldD0iX2JsYW5rIj5NZWRpY2FyZS5nb3Y6IERlZHVjdGlibGU8L2E+