Deductible vs Copay: What You Need to Know in 2023

The Basics of Deductible and Copay

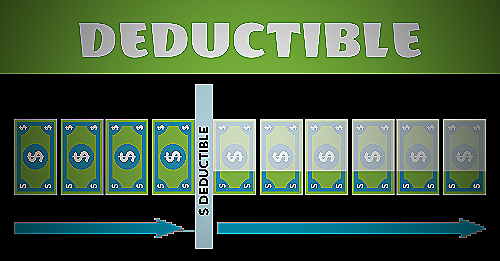

In simple terms, a deductible is the amount you pay before your insurance starts covering your healthcare costs. For instance, if you have a $500 deductible and your medical bill is $1,000, you’ll have to pay the first $500 out of pocket before your insurance company pays the remaining $500.

On the other hand, a copay is a fixed amount you pay for certain covered services. For example, if you have a $25 copay for a doctor’s visit, that means you’ll pay $25 for every visit and your insurance will pick up the rest.

Check out this Youtube video “Understanding Premiums, Deductibles, Copays and Out-of …” to learn the crucial difference between deductibles and copays in your health insurance plan!

What does Copay mean?

A copay, short for copayment, is a flat fee you pay out of pocket for certain covered services. It’s a common cost-sharing measure in many health insurance plans, and the amount of copay varies depending on the service you receive.

Define Deductible.

A deductible is the amount of money you pay out of your pocket before your insurance plan starts covering your healthcare expenses. In other words, it’s the amount you need to pay before your insurance plan kicks in.

The deductible amount varies by plan, and some plans may have no deductible at all. Generally, the higher the deductible you choose, the lower your insurance premium will be.

How Does Copay Work?

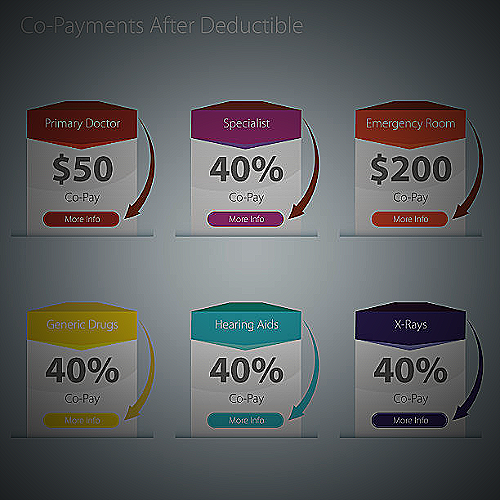

When you visit a healthcare provider, you pay the copay amount, and the insurance provider pays the rest of the bill for the service rendered. The copay amount is usually stated in your health insurance plan, and it is a fixed amount that you pay for specific services, such as doctor visits, prescription drugs, or emergency room care.

How Does Deductible Work?

Once you have met your deductible amount, your insurance provider will start paying for your covered healthcare services, and you will only be responsible for paying your copay or any other coinsurance required by the plan.

Which to Choose: High Deductible Plan or Low Deductible Plan?

The choice between a high deductible plan and a low deductible plan depends on your healthcare situation, budget, and preferences. If you’re generally healthy and don’t have many healthcare expenses, a high deductible plan may be a good option because it offers lower premiums.

If you have frequent medical needs or expect to have high medical expenses in the near future, a low deductible plan may be a better choice. It’s also important to check what kind of coverage each plan offers to ensure it meets your specific healthcare needs.

Understanding the difference between a deductible and a copay is essential in choosing the right health insurance plan for you and your family. A copay is a fixed amount you pay for certain healthcare services, while a deductible is the amount you need to pay before your insurance plan starts covering your healthcare expenses.

It’s important to consider your healthcare needs, budget, and preferences before choosing between a high deductible plan or a low deductible plan.

What is a Deductible?

A deductible is the amount of money you have to pay out of your own pocket before your health insurance plan pays anything for certain covered services. Deductibles are a fixed amount that you must meet every year and vary depending on your plan.

After you meet your deductible, your health insurance plan will start paying a portion of the cost for covered services.

What is a Copay?

A copay is a fixed fee or out-of-pocket expense that you have to pay at the time of service for certain covered medical services. Copays are usually a smaller amount than the full cost of the service, and it varies depending on the service and insurance plan.

Copays are not subject to meeting a deductible or coinsurance, and you typically pay them each time you receive covered services.

Deductible vs Copay: What’s the Difference?

The main difference between a deductible and a copay is that a deductible is an annual out-of-pocket amount that you must pay before your health insurance plan pays anything for certain covered services, while a copay is a fixed fee for covered services that you pay at the time of service. Deductibles are typically higher than copays and can range from hundreds to thousands of dollars, while copays are usually lower and vary depending on the service and insurance plan.

After you meet your deductible, your insurance plan begins to pay a portion of the costs of covered services, while copays are not subject to meeting a deductible but are usually required each time you receive covered services.

When Do You Pay a Deductible vs Copay?

You pay a deductible for certain covered services each year until you meet that amount, and then your insurance plan starts paying a portion of the cost for covered services. Copays, on the other hand, are typically paid at the time of service for certain covered services, regardless of whether or not you’ve met your deductible or coinsurance.

Which is Better: High Deductible or High Copay?

It really depends on your individual circumstances and healthcare needs. If you’re generally healthy and don’t anticipate needing a lot of medical services throughout the year, a high deductible plan may be a better option for you since the monthly premiums are usually lower.

However, if you visit the doctor frequently or take prescription medications, a plan with a higher copay may be more cost-effective for you in the long run. Ultimately, it’s important to choose a plan that meets your specific healthcare needs and budget.

Which Health Insurance Plans Have Copays and Deductibles?

Most health insurance plans have both copays and deductibles, regardless of whether they are offered through your employer or purchased on your own. These amounts may vary depending on the type of plan you have, whether it’s a PPO, HMO, or POS plan.

Other factors that may affect the amount of your deductible and copay include your age, health status, and location. Some plans have low copays and high deductibles, while others have high copays and low deductibles.

It’s important to review your policy details and consult with a healthcare provider to make informed decisions about your healthcare expenses.

Differences Between Deductible and Copays

Understanding the difference between deductible and copay is important in choosing the right health insurance plan. A deductible is the amount you pay out of pocket for covered services before your insurance plan starts to pay.

It is a fixed amount that you pay each year or benefit period. On the other hand, a copay is a fixed fee that you pay at the time of service for specific covered services.

Timing of Payments

The main differences between deductible and copay are their timing of payments. With a copay, you pay at the time of service, which helps simplify the payment process.

In contrast, with a deductible, you pay before your insurance plan starts to share the costs of your medical expenses. After meeting your deductible, your insurance plan begins to pay a portion of the costs for covered services.

Fixed Amount vs. Varying Amount

Another difference between a deductible and copay is the amount you pay. Deductibles usually vary depending on the plan and can be quite high, while copays are generally a fixed amount.

Copays may still vary depending on the covered service, but they are usually easier to understand and plan for compared to a deductible.

Covered Services

Copays are common for medical appointments and prescription drugs, while deductibles are usually associated with more expensive medical care like surgeries or hospital stays. The type of insurance plan you have and its coverage will determine what type of payments you will need to make for your medical care.

Now that you know the differences between deductible and copay, you can make more informed decisions when selecting the right healthcare plan for you and your family’s needs.

What Other Out-of-Pocket Expenses Can I Expect?

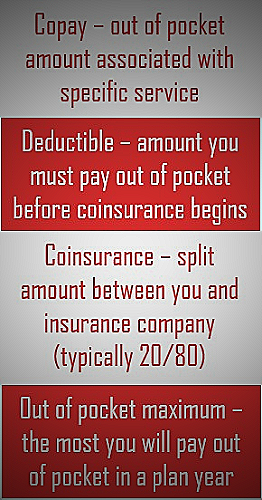

Aside from copays and deductibles, there are other out-of-pocket expenses you might encounter when you use your health insurance. One of these is coinsurance, which is the percentage of the cost of covered services that you have to pay after you’ve met your deductible.

This means that once your health plan starts paying for your medical bills, you’ll still have to share a portion of the costs with your insurer.

Another thing you might need to pay for is out-of-network services. This is when you see a medical provider or receive treatment at a facility that’s not in your insurance plan’s network.

In this case, you’ll usually have to pay more for your healthcare than you would have if you had used an in-network provider. In addition, some insurance plans have a cap on the amount they’ll pay for particular services.

If the cost of a service goes beyond this cap, you’ll be responsible for paying the difference.

Will I Have a Copay After I Reach My Deductible?

Yes, you will still have a copay after you reach your insurance deductible.

A deductible is a fixed amount of money you pay out of pocket for covered services per plan year before your insurance plan starts to pay. Once you meet your deductible, your insurance plan will begin to pay for covered services.

However, depending on your plan, you may still be responsible for paying copays for certain services, such as prescription drugs or specialist visits.

Although copays may not count towards your deductible, they can still add up and become a significant out-of-pocket expense throughout the year. It’s important to understand your plan’s copay structure and budget accordingly for these expenses.

A Note on Cost-Sharing Measures

Aside from understanding the difference between deductible vs copay, it’s also important to be familiar with other cost-sharing measures that can affect your healthcare costs. These include coinsurance and out-of-pocket maximums.

Coinsurance is a percentage of the cost of covered services that you pay after you’ve met your deductible. Out-of-pocket maximum, on the other hand, is the maximum amount you need to pay out of your own pocket during a plan year.

Once you’ve reached this amount, your insurance plan will cover all remaining costs for the year.

It’s crucial to know these cost-sharing measures since they can greatly impact your overall healthcare expenses. Always review your insurance plan and be familiar with the terms and services covered so you can make informed decisions about your healthcare needs.

Conclusion

Understanding the differences between deductibles and copays is important in managing your healthcare costs. Deductibles refer to the amount you have to pay before your insurance plan begins to cover your healthcare expenses.

On the other hand, copays are fixed fees that you need to pay for certain covered services. It’s essential to know the details of your insurance plan, such as the cost-sharing measures and other out-of-pocket expenses like annual deductibles and coinsurances.

Remember, even after reaching your insurance deductible, you will still have to pay your copay. By knowing these differences, you can make informed decisions about your healthcare expenses and make the most out of your insurance coverage.

References

- Verywell Health: What is a Copay and Deductible?

- Healthcare.gov: Cost-sharing

- Investopedia: Deductible

- Investopedia: Coinsurance

- Verywell Health: What is Coinsurance?