2023 NY SDI Tax Guide – Everything You Need to Know

NY SDI Tax refers to the State Disability Insurance tax in New York. It is important to know about this tax as it is a mandatory deduction from an employee’s paycheck and provides them with income replacement during an injury or illness-related work absence.

Check out this Youtube video on “Paid Family Leave Employer Q&A” for January 2022, to learn about NY SDI tax and get valuable insights on managing employee leave efficiently.

Overview of NY SDI Tax

New York State Disability Insurance (SDI) Tax is a mandatory tax that the state of New York imposes on employees’ income. It is designed to provide temporary cash benefits to employees who are unable to work due to a non-work-related disability, pregnancy, or childbirth.

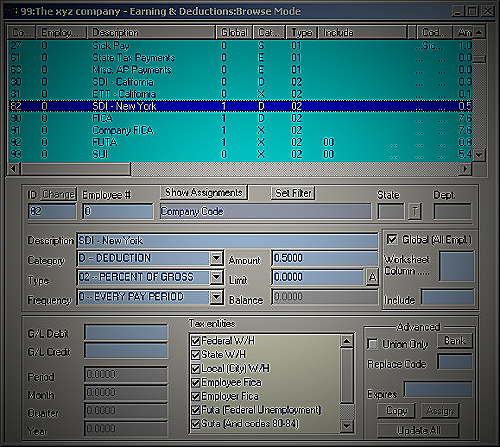

Compared to other states’ SDI taxes, New York has one of the highest SDI tax rates in the country. As of 2021, the SDI tax rate is 0.5% of an employee’s wages up to the annual cap of $76,104.

This means that the maximum SDI tax amount an employee can pay per year is $380.52.

One benefit of NY SDI Tax is that it provides employees with a safety net, in case they become disabled and are unable to work. The SDI program provides partial wage replacement for up to 26 weeks per occurrence, with benefits based on the employee’s average weekly wage.

Additionally, the program allows for job-protection during an employee’s disability leave.

NY SDI Tax Rates

The current NY SDI tax rate is 0.511% of an employee’s gross wages, up to a maximum of $75,408 in 2021. This means that the maximum an employee can contribute to the NY SDI tax for 2021 is $385.34.

Over time, the NY SDI tax rate has fluctuated. From 2016 to 2017, the rate increased from 0.50% to 0.50%.

In 2018, it went up again to 0.50%, and in 2019, it saw a significant jump to 0.75%. In 2020, it went down slightly to 0.50%, and in 2021, it has increased to 0.511%.

The maximum contributions for NY SDI tax are determined annually and are based on the state’s average weekly wage. For 2021, the maximum contribution is $385.34 per employee per year, while the minimum contribution is $10.22 per employee per year.

Who is Eligible for NY SDI Tax Benefits?

The NY SDI tax law mandates that employers in New York provide state disability insurance (SDI) coverage for eligible employees. Employers have the option to cover the full cost of state disability insurance or withhold 0.5% of the employee’s paycheck.

Eligible employees must be employed for at least 30 days consecutively or not.

To be eligible for NY SDI Tax benefits, employees must satisfy some requirements like having paid at least $1,300 wages in their highest calendar quarter of the base period, which is the period of one year ending on the last day of the last calendar quarter before their disability begins. Also, employees must have been actively employed on the first day of the disability.

NY SDI tax benefits also cover employees who have been laid off. If they became disabled within four weeks of their layoff and can’t work due to their disability, they may be eligible for disability benefits.

Applying for NY SDI Tax Benefits

Are you eligible to apply for NY SDI tax benefits?

Before applying for NY SDI tax benefits, it is important to determine if you are eligible. According to New York State Disability Benefits Law, every business with at least one employee for more than 30 days in a calendar year must provide disability insurance.

This 30-day requirement does not need to be consecutive. If you meet this eligibility requirement, you can apply for NY SDI tax benefits.

How do you apply for NY SDI tax benefits?

In applying for NY SDI tax benefits, you need to fill out the Employee Statement of Sickness (Form DB-450) which is readily available on the State of New York Department of Labor website. The form must be completed and submitted within 30 days of the first day of the disability or the date of the disability leave.

What are the required documents?

When filing for NY SDI tax benefits, the following documents are required:

- Employee Statement of Sickness (Form DB-450)

- Medical certificate to be completed by your licensed health care provider

What happens after you file your claim?

After filing your claim, it will be reviewed by the New York State Department of Labor and you will receive a determination letter. If your claim is approved, you will receive weekly benefits which are based on a percentage of your average weekly wages, with a maximum of $170 per week (as of 2021).

The SDI benefit will be paid for a maximum of up to 26 weeks within 52 consecutive weeks.

Conclusion

The ny sdi tax is an important aspect of employee benefits in New York. Employers must provide state disability insurance coverage for eligible employees, either by covering the entire cost or withholding a portion of employee wages.

It is important for employers to understand their responsibilities and accurately report and remit ny sdi taxes to avoid penalties and legal issues.

References

- New York State Department of Taxation and Finance: State disability insurance (SDI) withholding

- New York Paid Family Leave Official Website: Employer information

- New York State Worker’s Compensation Board